M Kumar, GM - Brand Development, Jagran Engage

Digital OOH started off in the last one year or so. Though it expands the overall OOH market, it still remains to achieve critical mass. As a medium there is a possibility of interacting with the TG on real-time which needs to be exploited. In large formats we have been hearing a lot of opportunity with blue casting but we haven’t seen much happening on that front.

Digital OOH started off in the last one year or so. Though it expands the overall OOH market, it still remains to achieve critical mass. As a medium there is a possibility of interacting with the TG on real-time which needs to be exploited. In large formats we have been hearing a lot of opportunity with blue casting but we haven’t seen much happening on that front.

Born and bred in Mumbai, Kumar is a media professional with over 18 years of experience. Over these years he has seen the media landscape dramatically being altered. He started off his career with a five year stint with Bennett Coleman & Co Ltd and thereafter for three years with the erstwhile FM stations HMV & Radio Mid-day (remember those were early days of FM yet). He went on to work with FMCG major Pepsi - handling the enviable brand portfolio. Then came the opportunity to work with service driven Club Mahindra Holidays as Regional Marketing Head followed by a national responsibility at the corporate office in Chennai. Became head of marketing at a JV with a Tata group company in Pune before moving back to Mumbai as General Manager at Jagran Engage – a leading OOH player in the country. A keen theatre enthusiast and a “just-turned” fitness freak, Kumar is bullish on the OOH media space and shares his thoughts on key issues facing the business.

In conversation with Pallavi Goorha of exchange4media, Kumar talks about the economic slowdown and the technological advances that the medium is taking. Q. What are the new businesses that you have bagged in the past six months?

Despite a slowdown in the OOH space, we have been able to bag new campaigns in the last six months. These range across categories - few of which have been regional and some national. Castrol, DLF, Dettol, Usha Fans, Max New York, Pepsi, Morgan Stanley, Citi financial, UCO Bank etc.

Q. How big is the outdoor advertising industry? What is the share of OOH in the total advertising industry?

Our guesstimate is around 1800-1900 Crore excluding retail. It’s share is 7 percent of the overall advertising pie.

Q. How different is it working with clients directly and with agencies?

As a leading OOH company in India we have separate teams catering to business coming in from direct clients as well as agency. The skew until now was in favour of agency business but now a lot of focus has come in for direct clients as well. The principal difference lies in the fact that an agency is aware of our inventory and as and when required for the client procures it from us – the process is a largely a “pull driven” one whereas with a direct client we need to sell our media as well as media available with other owners to cover a city for a particular campaign – the process is a “push driven” one. A direct client is more open to using tools as compared to an agency. It is easier to suggest innovation to a direct client as compared to an agency. A healthy business mix augurs well for an organisation such as ours.

Q. What are your future plans of Jagran Engage?

As an organisation we are investing in tier II & III cities where consumption is likely to grow. As a media opportunity street furniture is a good proposition as the formats available are varied and can be customised as per the needs of a prospect. Another focus area in the tier II & III locations is the transit media like important Railway stations and intercity bus terminals.

We are also embarking on a specialist agency model where we will undertake large campaigns for clients as per their market requirements. The underlying advantage of competitive costs on account of also being a media owner is a big bonus for us. Needless to say, all services associated for an effective campaign will be provided to clients.

Q. How has the economic slowdown affected Jagran Engage? How do you view the OOH market in terms of the slowdown?

The economic slowdown has affected the whole media space and OOH as a medium is also affected. Jagran Engage, too, is no exception. The effect was stark post-November 2008 and continues even as we speak. However, if one saw a reduction in ad spends by close to 30-35 percent in the November to January period, you can notice an improvement (approx 15-20 percent now) in the last couple of months. Basically, if you were witnessing a large number of empty billboards earlier, the numbers have now declined. What is interesting is that some categories such as telecom, finance, insurance, government, education, airlines, media and entertainment companies, etc are still bullish on outdoors and continue to spend on the medium.

Quite a few big campaigns that were to take off towards the start of Q4 in this financial year have been staggered towards the H1 of the next financial year, so it’s not as if the OOH spends won’t happen, just that it has been slightly deferred. Summer is upon us and we can hope to see FMCG companies using outdoors, so we will see some spends happening on that front too. From a client’s point of view, there couldn’t have been a better time – they are able to get cream sites, which were hitherto unaffordable, and media owners are falling over each other to bundle huge value deals. Also, accountability from media owners is on the rise. We at Jagran Engage believe that this market scenario is likely to continue for a little more time – maybe another 4-6 months before the trend is reversed.

Q. What is your view on advertising in radio cabs?

Radio cabs as an OOH option is quite an interesting one – one can engage with it while getting into it as well as after one gets into it. That said, advertisers are really not rushing into it and at best currently it will complement a campaign as an element. In our country we often can see vinyls peeled off on the cabs – so maintenance parameters have to be set and monitored from time to time. Also, the operators have to do quite a few things before it can be used to its optimum level – things like a LCD screen inside, touch points with customers, GPS etc.

Q. What are the technological advances that the medium is witnessing? How would you compare OOH ad spend vis-à-vis total ad spends done by brands/companies?

Digital OOH started in the last one year or so. Though it expands the overall OOH market, it still remains to achieve critical mass. As a medium there is a possibility of interacting with the TG on real-time which needs to be exploited. In large formats we have been hearing a lot of opportunity with blue casting but we haven’t seen much happening on that front. Once the basic issues with OOH (metrics, site evaluation tools etc) are taken care of, I guess we can move a notch up and seriously start using technology as an enhancer for the business.

Q. How do you compare the Indian outdoor advertising industry with the global market?

Globally the industry is pegged around $25 billion while the Indian outdoor advertising industry is around $0.4 billion. Clearly there is huge opportunity for growth once the effect of the economic slump wears off.

Q. What are the new tools that Jagran Engage is focussing on?

The tools that we developed (creative evaluation, uploading the entire campaign with photographs online, our location optimiser) are all web based and were as a result of the need gap analysis that we undertook some time back. These were pretty basic in nature yet very useful and we believed that once this was taken care of we can then build on them. Our efforts in the last one year was therefore, focused on aggressively pitching these to prospects and clients alike. The result of this push is that now clients are using our tools pre campaign and post campaign. They have also been useful in offering tremendous transparency to them which was otherwise missing. We have been thinking on building interaction between the brand being advertised and the TG for a long time now and once we reach critical mass, we will soon look at that.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Laqshya Media Group introduces technology to measure OOH ad reach in India

SHARP, an AI empowered tool from Laqshya Media Group will help measure the effectiveness and media value of outdoor ad campaigns with supportive numeric data

Just when advertisers were shying away from the medium, the Out of Home (OOH) industry outdid itself in terms of creative, innovations and reach. With a fair dosage of digitizing itself, OOH is now ready with its next big disruption. Addressing the only possible drawback of the industry which is measurability, OOH is all set to put numbers to its reach.

Laqshya Media Group (LMG) has introduced the disruption in the Indian market. The Delhi-based OOH brand has launched ‘SHARP’ (Strategic Hyperlocal AI-powered Reach Planner), a first-of-its kind planning tool for measuring the effectiveness and media value of outdoor campaigns.

What is SHARP and how does it measure the reach of OOH ads?

The OOH tool uses machine learning to deliver AI-optimized metrics and recommendations. The system is fed with data received from more than 50,000 geo-tagged sites comprising of Billboards, BQS sites, mall facades, pillars and poles across 26 cities. SHARP combines diverse data points including geotagged OOH locations across formats, traffic measurement studies by global research agencies, multiple databases to map and measure the current profiles of resident and transit population and panel rating points, and various other site factors with the data on thousands of sites across multiple OOH formats.

Each site is geo-tagged and cross-linked with google-map APIs to indicate various relevant points of interest like banks, auto showrooms etc. from the site. SHARP is also coded to differentiate between multiple (stacked) billboards at the same location with indicative pricing per site.

Though new in India, OOH measurability has been a global topic of discussion and markets like Paris, South Africa, US and Australia already use AI driven tools to measure the reach of ads on the platform.

This move comes in at the right time for the Indian market. “Since the industry is facing an evident slowdown, we want to work in consolidation with the industry to help it grow. We will focus on technology as it plays an important role for any OOH firm,” said Atul Shrivastava, Group CEO, Laqshya Media Group (LMG).

Speaking about the advantages of measurability, Shrivastava said, “This is India’s first ever measuring tool, developed in-house by LMG that allows brands to target the right audiences with reach or a budget as an objective for an OOH campaign.”

“Brands are inclined towards measurement as it gives them better ROI’s. They know the engagement level and plan their investments accordingly,” he added.

LMG is best known for their iconic advertisements with clients such as Maruti, LG, Quikr, Myntra, Shopper Stop, Platinum Guuild, a Tanishq, Flipkart.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

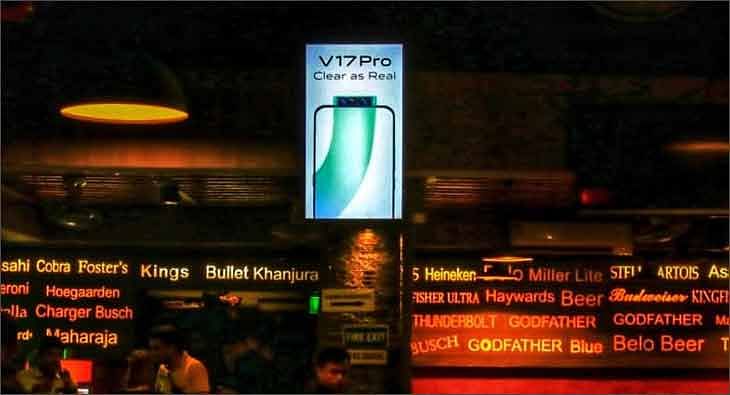

Vivo and Eyetalk Media Ventures leverage programmatic DOOH for V17 Pro campaign

The campaign has been executed across pubs and cafes with TagTalk and in premium tech and business hubs with the newly launched real-time business DOOH network – Biztalk

Vivo Smartphone rolled out an extensive two-month-long national campaign for the new V17 Pro handset with Eyetalk Media Ventures. Using the power of technology and content to connect with the digitally driven audience the programmatic campaign has been executed across pubs and cafes with TagTalk and in premium tech and business hubs with the newly launched real-time business DOOH network – Biztalk, a joint venture between Eyetalk Media Ventures and Drsti Communications.

The V17 Pro campaign reached young millennials and over 1.5 million employees daily from some of the biggest global companies like IBM, Cisco, KPMG, EY, Accenture, Amazon, Google, HCL etc with over 7.5 million optimized ad impressions delivered during peak hours paired with audience - environment centric content like location-based live photo sharing on TagTalk and live technology news on Biztalk for higher brand recall and engagement.

The DOOH campaign executed in 3 phases – #ClearAsReal photography prelaunch campaign in collaboration with National Geographic, launch and Diwali campaign is currently live across 600 displays across both TagTalk and Biztalk Networks in Delhi, Gurugram, Mumbai, Pune, Bengaluru and Hyderabad.

Speaking on the development, Prince Gaur, Senior Manager of Marketing, Vivo Smartphone said, “Consumer & Innovation are 2 core pillars of Vivo and DOOH has played a significant role to further strengthen them. We have been able to capture the right TG, who are affluent and digitally driven at right time and at right place. Through the mix of Tagtalk & Biztalk, we have been able to capture our TG at 2 most critical touchpoints, multiple times throughout the week. Programmatic planning on both the networks has helped us drive best efficiency out of this campaign.

Adding to this, Gautam Bhirani, Managing Director, Eyetalk Media Ventures said, “With over 600 live displays reaching over 1.7 million urban Indians daily at a click of a button across 2 key urban ecosystems the V17 Pro campaign is probably one of the biggest DOOH campaigns to be executed in India. Both our networks reach digitally-driven, affluent urban audience in a captive environment, the high dwell time gives us the opportunity to communicate and connect better which enabled us to build an effective storyline using our content assets on our audience engagement platforms.”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

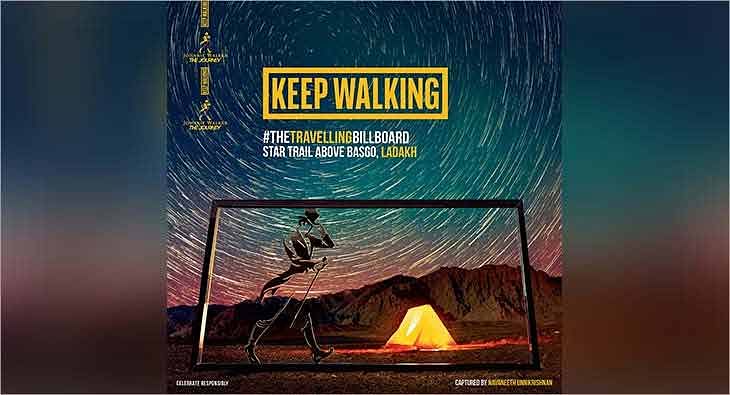

Johnnie Walker sets off on exploration and discovery with #TheTravellingBillboard

This OOH and digital media campaign will capture the live journey undertaken by a life-size billboard with the brand’s striding man logo exploring unchartered terrains and exotic locations in India

Johnnie Walker The Journey is proud to unveil #TheTravellingBillboard, a first-of-its-kind campaign that brings together India’s most influential travel photographers.

The striding man as a Johnnie Walker icon has always symbolized the idea of progress and moving forward. As a brand that has been passionate about exploring the world for nearly 200 years, Johnnie Walker’s #TheTravellingBillboard pays tribute to this exploratory spirit that challenges people to taste more out of life by pushing boundaries.

Conceptualized by brand solution partner What’s Your Problem, #TheTravellingBillboard shall travel to places which only a few people have visited, and also where no billboard has been before. All this, to inspire people to explore the world and seek out unique stories.

The billboard’s travel includes unexplored destinations from all corners of India that include the Basgo Plains, one of the best locations in the world to stargaze. The abandoned Kuldhara village, which is ripe with its own fantastic lore and even the underwater terrain of Andamans. #TheTravellingBillboard will be accompanied by some of India’s most influential travel photographers who will capture the final destination in their own style.

The final photographs will become the lead creatives across OOH at some of the most prominent outdoor sites in the country. The untold stories of these unchartered locations and the journey of photographers along with the billboard will also be captured through a digital content series.

Further, the campaign will be amplified with the help of 150 social media influencers who, through a miniature version of #TheTravellingBillboard of their own, will capture their own unique experiences and journeys. The brand will also deploy an Instagram filter for the entire country to join the campaign and capture India’s beauty in their own ways.

Speaking about this campaign, Abhishek Shahabadi, VP and Portfolio Head: Premium & Luxury brands at Diageo India said, “Exploration has been at the heart of Johnnie Walker, over its 200 years of being. The brand instigates exploration of the rich possibilities of our world to discover experiences that satisfy a thirst for life. Keep Walking is all about pushing boundaries to taste more out of life. This campaign celebrates this philosophy and is aimed at bringing to life the rich character of unchartered India through this exploration.”

“Today people love to engage with brands that are making them a part of the creative journey and so at the heart of this campaign is the desire to fuel exploration and to democratize the content creation across multimedia touchpoints and let everyone participate.”

#TheTravellingBillboard is designed to be a collaboration of explorers and photographers (everyone with a phone camera qualifies) who can tell the story of these uncharted locations through the Johnnie Walker lens in their unique styles. Hence, we not just have some of the country's most loved photographers travelling with billboard, but also have mini versions of the billboard travelling to all aspiring shutterbugs making it also a digitally travelling campaign” adds Khushboo Benani, Content and Influencer Marketing Head at Diageo India.

Speaking about the campaign, Ruchita Zambre, Group Creative Director, WYP, & Tejas Mehta, Strategy & Business Head said, “The brief from the Diageo team came in to do an OOH led campaign. After studying the international work done by the brand, we all felt that a basic OOH campaign will never do. It had to do more, create conversations, engage consumers. This thinking led us to create #TheTravellingBillboard. An OOH that roams the country in search for unique vistas. Thus, pushing the boundaries of what a billboard campaign can be like. Completely in line with the brand’s philosophy of pushing boundaries. And WYP’s philosophy of coming up with solutions that go across media and are truly integrated. A campaign of this kind required collaborating with various partners – for fabrication, media plan, digital amplification, photography, innovation etc. The campaign hasn’t been easy to execute at all. But where’s the fun in easy, right?”

The campaign will be on till December end. You can follow the journey through #TheTravellingBillboard or https://www.socialgoat.in/thetravellingbillboard

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Economic slowdown hits OOH industry; spends drop 10-15%

Industry experts say that while the OOH industry has picked up pace during the festive season, spends on OOH have decreased over the past months

If you are driving on the expressways of Delhi and Mumbai, the hoardings on both sides of the road are hard to ignore. However, recently, the number of vacant outdoor sites seems to be increasing by the day. It’s an indication that the economic slowdown has had its effect on the OOH industry.

According to Indrajit Sen, an independent consultant, the spends on OOH have decreased by 10-15 per cent in the past months, and the overall occupancy has dropped by 25-30% per cent. “There are many campaigns which have been postponed or shelved. Besides, brand owners have also shortened the duration of existing campaigns", he said.

Thanks to festivities, the OOH industry has picked its pace a little. But the biggest spenders are the likes of Amazon and Flipkart’ who remain unaffected by the apparent slowdown which has hit the OOH industry.

In the past, the biggest spenders in the OOH segment have been real-estate players, automobile brands, OTT platforms, mobile handsets, airlines and broadcasters, but many of these sectors have been hit by the economic slowdown.

“We have witnessed it, but because of the festive season, it is looking a little better. Before the arrival of the festivities, things were not how it was last year. There is an evident difference, we have observed,” said Haresh Nayak, Group MD of Posterscope, South Asia, India.

"The ban on OOH signages has indeed spread like wildfire across the country. While this is still very much in action in Bengaluru, this is apparent across other cities as well. This is largely due to the fact that the government wants to regulate this medium which has been largely running on its own, and in many sections, by people having their own site/location without any legalities attached to it. This had to happen a long time ago but with the new rules and regulations coming in, the scenario is changing a lot and in many ways, I guess it is better for the industry in the coming months,” said VV Rajan, Co-founder, CMO, Urbaniq.

Explaining why there has been a shift in spending on the medium during the last quarter, Rajan said, “As per the Pitch Madison Advertising Outlook Report 2019, they have revised their forecast owing to a drop in the TV Adex during the first quarter of the year. And according to the original report that was released earlier this year during February 2019 Adex, it was forecasted to grow by 16.4% to touch ₹70,888 crores but the numbers seem to have come down to 13.4% to approximately ₹69,000 crores.”

He added, “A lot of this has to do with the macroeconomic slowdown leading to a fall in the domestic consumption. For example, we have seen that the auto industry has spent lower on this medium, unlike last year which is attributed to the fact the there has been lower demand in the last couple of months. The auto industry overall is the No.2 spender on the overall advertising pie. This will obviously have an impact on the OOH media as well. At the same time the rise of OTT has had a major role to play in this medium.”

However, according to experts, in the long term, this medium is more impactful than other mediums (TV, radio and Print) which require active participation; ambient media will continue to be effective. Other traditional media will continue to lose market share due to the changing media habits of the younger generation. “DOOH is transforming the medium so instead of more “faces” or locations, you will see fewer but more impactful options. This will be a “win” overall for advertisers,” Rajan opined.

Talking about if the industry will pick up its pace in the future, Sen said, “Outdoor will bounce back simply because of its cost efficiencies. To support an economy growth post slowdown, advertisers will have to look at outdoor because it continues to be cost-effective.”

“Yes, business is indeed affected by monies shifting to other media due to this but eventually it will come back once rules are set in place,” Rajan added.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Digital conversion in Kerala OOH industry will take time: Experts

Industry experts believe cities in Kerala have not fully adapted to Digital OOH since there is still a strong preference for traditional OOH advertising

Out-of-Home Advertising or Outdoor Advertising remains one of the prime modes of advertisement in Kerala. According to industry experts, the OOH industry in the state is has a turnover of almost Rs 350-400 crore per year. Recently the state has banned flex materials made from polyvinyl chloride (PVC) citing health and environmental issues. As per the order from the Department of Local Self Government, PVC flex should not be printed or used for government functions, private or religious events, cinema promotion or advertising.

In the wake of this, is it high time that the OOH players in the state shifted to digital billboards? Unlike other South Indian cities such as Chennai, Bangalore and Hyderabad, the cities in Kerala have not adapted to DOOH.

We spoke to industry experts to get their take on the subject.

“It is probably a demand vs supply situation. The options for regular OOH formats are much more in demand and remain sold through the year so no one complains. A lot of advertisers today still believe in the traditional mediums like static OOH, unlike digital mediums. Also, many static OOH ads are large formats and hence lends visibility to the brands much easier. Digital OOH, on the other hand, may have deeper penetration and much better measurability and ROI but still, clients today in Kerala want OOH formats which are impactful and visible,” observes Venkata Varadarajan, Co-founder, CMO, Urban IQ.

“In many ways, the Kerala OOH business scenario is no different from those seen in non-Metro markets across the country. For one, the media ownership is highly fragmented, and as a result, their businesses are not scalable, whereas in the digital OOH (DOOH) environment the ROI will kick in only if the asset ownership is at scale,” said S Kumar, Managing Director, Srishti Communications.

Kumar continued, “It is also important to note that DOOH is a not a like-for-like replacement of the traditional OOH formats. The display part is only one aspect, which of course, meets the eye of the advertisers and consumers alike. Instead, DOOH calls for investments in software solutions, IT networking, hardware investments including their AMC, among others. Media owners who have been accustomed to investing in a few traditional units like hoardings and billboards will be hard placed to garner funds for investing in the tech-driven media for the longer term.”

So what stops the OOH players from shifting to digital formats?

“The existing OOH regulatory environment in Kerala is also not a great enabler of DOOH business. True, the state government has placed a ban on the use of PVC flex for advertising and publicity purposes, while mandating that the industry should switch to green options. But, there has been no policy measure to promote the use of DOOH in any of the markets in the state. Given that the norms governing digital OOH across the country are archaic, the media owners in Kerala will not have the confidence to even invest in DOOH assets in the fear that the authorities may come down heavily on the DOOH formats for some unforeseen reason in the future,” said Kumar.

“In order to shift to digital billboards, the government should be able to provide support and confidence to OOH players in Kerala. A few years ago, neon boards which were hosted in some part of Cochi city were removed citing that the public is getting distracted by the boards while driving. The hosting of digital billboards requires huge initial investments and if the aforementioned situation arises, then it will be a problem for the players,” said Biju Babu, a veteran in the OOH industry.

Talking about the challenges Krishna Kumar of Whisper Media said, “The initial investment required for digital billboards and its maintenance is a huge issue among the OOH players. Lack of awareness and proper professional guidance and maintenance is also a concern, and in terms of ROI, this might be another challenge. But we should be optimistic, the whole scenario will improve and gather a positive momentum very soon.”

According to Kumar, DOOH is growing in the transit media space, such as at the airports, Kochi Metro network, railway stations and the like.

“That is where DOOH will gain ground increasingly, and in time, as the city authorities deem fit to bring DOOH into the scheme of city beautification, we will hopefully see DOOH replacing the traditionally large and short formats in the outdoor space, unit by unit. DOOH adoption is also contingent on the cost of hardware and software solutions coming down,” added Kumar.

Talking about the digital conversion in the state Varadarajan said, “The digital conversion will take some more time in Kerala since traditional OOH has a very strong presence to the point of becoming a habit with advertisers to use them in their campaign strategies. And while the affluence and development are still on the rise, the market is largely traditional in the way media is consumed.”

He added, “OOH growth is very limited in Kerala and the chance to transition to Digital for upcoming locations is also limited. Only when the OOH media gets more regulated will there be a change in the way digital formats will find its way into the media spaces. And that will also happen with the overall cities and towns becoming smarter with their solutions for the general public.”.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Ahmedabad, Indore, Chandigarh, Pune are emerging markets in OOH: Haresh Nayak, Posterscope

Nayak, Group MD of Posterscope, South Asia, India, talks about the different kinds of avenues brands tap into while leveraging OOH during the festive season

The industry is currently is reportedly going through a major slowdown and brands are cutting costs to stay afloat in the segment but not during festivities. Yes, here comes the festive season and happy times for brands and the media industry arrives too.

We spoke to Haresh Nayak, Group MD - Posterscope- South Asia, India to understand what are the different kinds of avenues brands tap into while resorting to OOH during festivities; the emerging markets and what kind of brands are investing heavily during this time of the year and more.

Edited excerpts:

What are the different kinds of avenues brands can tap into while leveraging OOH?

There are a lot of avenues, from different markets to different types of formats. In the coming 2-3 months, there will be a lot of activities in the OOH space but a client can also look at DOOH where a lot of engagement activity can be done along with the traditional media and digital media. At places like malls and beauty parlours, there are a lot of captive audiences present. So, within these spaces, there are many options today. We have been doing initiatives in malls and colleges. We are looking at beauty parlours as a big segment because a lot of engagement is there during the festive season.

Also, we're trying to do something where potentially a lot of talking is going to happen in a mall. We are not only looking at digital and traditional media options within the mall but also doing geofencing and connecting them with digital. For example, we did a combination of social media along with the traditional OOH or DOOH in the mall and if someone is surfing something on the net, he/she will get to see a similar notification on their handsets.

Which brands are investing more in OOH during festival season?

Automobile brands such as Maruti Suzuki, Honda, and mobile handset as a category with brands such as Oppo, One plus, Redmi etc, are active right now. All the FMCG brands and e-Commerce brands opt to invest heavily during this time of the year with their discounts/offers. Banks namely Standard Chartered and HDFC are active too with their offers of debit/credit cards.

What kind of OOH is working? Is it the celebrity hoarding or is it the traditional billboards, what is it that's working in terms of creatives?

It is a combination of everything. In a world which is so cluttered and complex, every customer is different. Ultimately we need to have a communication which is reaching one-on-one and not going to many. So, in this scenario, you cannot say that one activity will work or two activities will. It needs to be a holistic 360-degree view and a combination of everything.

What are the emerging markets in the OOH space?

Markets like Ahmedabad, Indore, Chandigarh, Pune are the new emerging markets. The reason being, we have good quality out-of-home media inventories in place and different infrastructure in place. If you look at beyond these four metro cities, I think these small cities are learning quickly and not repeating the mistakes done by the metros because the learning curve is much faster.

How are brands today investing their advertising budgets in emerging markets?

It depends a lot on their marketing; everything starts with it. There are a lot of factors including their goals, objectives, whether their product will penetrate in the market way better. Brands are available in metros because the population is larger, so the potential is more in terms of location. Brands like Mahindra and FMCG brands are also working in the rural markets, because the demand in the rural, as well as, the metro is equal.

Do different brands look for different positioning to target a specific audience base?

That’s our goal as an agency. Every agency has its own unique way of planning. We don't consider outdoor advertising companies; we push within ourselves as a location-based marketing company. The moment you chose a position, the data analytics, technology and insight which you are able to provide to your client to take the right decision is very difficult. And for us, the kind of investments we have done in various API’s and data points, we are able to make those decisions.

We are also looking at influencers who will work with us. We are also looking at the key markets and suggesting celebrities or influencers who are right for brands for hyper-local penetration and creating content. Various initiatives have been taken by brands to become more accountable and also more hyper-local.

For example, Flipkart investing their advertising budgets in emerging markets and Coolberg as an upcoming brand that does the same.

Is the OOH industry a victim of economic slowdown?

Yes, we have witnessed it, but because of the festive season, it is looking a little better. But before the arrival of the festivities, things were not how it was last year.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Laqshya launches OOH campaign for Tanishq's Virasat collection

The outdoor duties were assigned to OMI, the outdoor agency arm of Laqshya Media Group

Tanishq has launched a new OOH campaign marking one of the most anticipated festivals of the year, Diwali! For this auspicious occasion, Tanishq is launching its new festive collection- Virasat.

The OOH campaign brings alive the essence of age-old traditions, cultures and rituals which have been followed through generations. The campaign aims to take forward this tradition of purchasing jewellery which makes Diwali auspicious and special for all of us.

The high decibel campaign was devised to announce the Virasat collection stridently with a striking effect. The outdoor duties were assigned to OMI (Outdoor Media Integrated), the outdoor agency arm of Laqshya Media Group.

OMI used its in-house proprietary tool ‘SHARP’ to give the campaign high visibility & create maximum impactful exposure. The deployments were done in a way as to cover all arterial routes and important touchpoints that were imperative as per the TG’s day in the life cycle. A mix of media vehicle ensured that we attain the objective of reaching the right audience multiple times building brand salience.

The campaign was executed by strongly developing the brand’s communication in multiple cities like Agra, Ahmedabad, Allahabad, Bangalore, Baroda, Bhubaneswar, Chandigarh, Chennai, Delhi NCR, Guwahati, Hyderabad, Indore, Jaipur, Jamshedpur, Kanpur, Kolkata, Kolkata Upcountry, Lucknow, Ludhiana, Meerut, Mumbai, Nagpur, Patna, Pune, Raipur, Ranchi, Surat, Varanasi and Vijayawada.

Tanishq’s extraordinarily stunning creative looked equally mesmerizing on the OOH canvas that was handpicked by OMI to ensure that it gets the 100% OTS it demanded from the campaign. Every media unit did complete justice to build the buzz for the campaign leading to conversations and finally considerations.

Speaking further on the campaign, Naresh Bhandari, COO, OMI, Laqshya Media Group said, “Diwali and Tanishq are essentially connected to each other. Buying gold in Diwali has been a big part of our tradition across the country. This Diwali offer by Tanishq needed a much fierce noticeability at the time when all the competitors are active on OOH and vying for consumers attention. The team took it as a challenge to ensure we are not just noticed but, we impact them too. The dual approach of attaining reach and frequency using our In-House tool cut corners and we were able to deliver a successful campaign.”

Commenting on the campaign, Deepika Tewari, Associate Vice President– Marketing, Jewellery Division at Titan Company Limited said, “Each Diwali is a testament of the tradition that has been passed down from one generation to another and has been followed each year with equal vigour. This collection is a tribute to the innumerable ‘Rivaaj’ or traditions that are followed by us, especially that of buying gold and hence the name ‘Virasat’. We sincerely hope our exclusive festive offers along with our grand new Virasat Collection will add a bit of sparkle to everyone’s life. At Tanishq we wish everyone to be a part of Rivaajon wali Diwali, Tanishq waali Diwali”.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Share

Share