Vivid: Web journalism is here to stay

Online journalism in the West grew on the decline of print. In India, it gained popularity as an avatar of print, says Annurag Batra of exchange4media

We have a habit of following the West. What happens in that part of the world inevitably travels to the Subcontinent. Similar is the advent of online journalism.

In spite of its constant newness, in terms of experimentation and adaptation, journalism in India has its beginning in the birth of nation itself. When the British had consolidated their Raj over the country, the print media were of two types – those run by the imperialists and those using these tools of communication to spread the word of freedom. By the time the British left in 1947, the Indian print media was a well-established entity, with publishers and editors participating, commenting on the dawn of the post-Independence political environment, even participating as a voice of the people. The leaders of the then India, led by first Prime Minister Jawaharlal Nehru, univocally made the media responsible to inform about the politico-socio-economic development of the country. The media also stood a watchdog to sound the alert on issues setting up a new nation was bound to face.

Over the years, the print media found various issues to write about: the changing polity, the agriculture – India is by and large an agrarian country, women issues, social evils, issues pertaining to the economy, developmental needs, infrastructural challenges and opportunities, communal standoffs, unemployment, wars with uneasy neighbours, the great rich and poor divide...all found space in the morning newspapers and a handful of magazines.

Perhaps it had become a powerful voice of the people too fast too soon, perhaps the detractors realised just how damaging the watchdogs’ watchful eyes could be in ‘inciting’ people’s response. By the time the mid-seventies rolled in, the Press found itself right in the middle of one of the most challenging times, the Emergency of ’75-’77. There were concentrated attempts to censor and gag the press.

But the media resisted; successfully. Soon, newspapers became not only powerful entities but strong institutions. And the publishing industry went on an overdrive. Soon houses emerged, with strings of newspapers, magazines and journals. An interesting phenomenon was the rise of children’s magazines. If the Times of India had ‘Chandamama’ with the ‘Vikram-Betal’ series, India Today had ‘Target’ with ‘Detective Moochwala’ series.

Newspaper publishers also felt the need to foray in the vernacular. Those who did anew, found a fresh avenue and those who already had vernacular properties, found renewed strength.

This was the scenario greeting the media in India when pro-globalisation and liberalisation policies were initiated in 1991. This was an altogether shift from the Licence Raj, an economic environment which opened doors for international players to enter the Indian media market. The phenomenon of computers in the West was also migrated to Indian newspapers and the era of desktop-publishing began. When VSNL introduced the internet in India for the first time in 1995, it was only a matter of time for mobile phones, laptops, broadband to become part of the news-gathering and news-dissemination apparatus.

It was also a matter of time that journalists would explore the online space not only as a professional imperative but also as a medium to express their creative zeal. Let’s not also forget the advent of TV journalism – again, a post-Liberalisation phenomenon – which made print media journalists a better way to connect closer to their readership, the online way.

Despite the fact that India hooked into the cyber world only in the mid-nineties, quite a late entry as compared to the West, the growth in IT and IT-related procedures has been phenomenal. Further, driven by youth, internet subscriber base in the country is expected to reach 150 million by the end of this year, according to a report by Internet and Mobile Association of India and IMRB said. “As of June 2012, there are 137 million claimed Internet users in India (99 million from Urban India and 38 million from the rural parts of the country),” the report stated.

Of the 137 million claimed users, there are 111 million active users, with the number of active users growing at the rate of 19 per cent, faster than the claimed users.

No wonder, then, that nearly all national newspapers and magazines, irrespective to what language they are published in, have their e-papers. A rising trend among journalists is to tweet, blog or set up their own sites.

Based on such successes, the Indian media now has online-only popular entities such as ‘firstpost’ and ‘rediff’.

Although it's been slow, Web journalism is gaining steady ground within Indian journalistic circles, interestingly, for reasons just the opposite than the West. For the US and the UK, online journalism grew on the decline of print journalism that began as early as the late eighties. In India, it gained popularity as an avatar of print.

In fact, online has been a sort of a ‘force multiplier’ for print, delivering where the later failed, establishing a ‘now’ factor that print never had. For example, with the rise of so many news channels, the morning newspaper rolling out news a day later has become a bit less interesting. Further, one must also understand that online, by far, is the most irreverent and exhaustive of mediums. The variety, further, enhances capabilities of in-depth analysis, opinions, giving space for inputs and bettering visuals. This, in turn, allows more transparency.

For example, a whodunit murder where a politician is a suspect. A news wheel can carry only so many reports or a newspaper has just so many pages. On the net, it is possible to place all angles of such an incident without a worry over shortage of space.

Further, gone are the days of the ‘vinyl work’ – coloured pages, boxes, packaging – that impressed the readers. Today they want more information, and the net wins hands down.

It’s also the depth that matters, for online journalism allows stakeholders create and consume reports in many different, varied, new types of languages and features, where multimedia and interactivity play essential roles. Add to that the social tools and you have no limitations – not even geographic – to read, watch, absorb and even contribute news from any part of the world, limitlessly.

Let’s also not forget the cost-effectiveness of online journalism over print. At the same time, there is a bit of an identity crisis. In fact, it is more like an identity search, even as media groups learn the ropes to define strategies to cope with the new demands brought by the internet. For example, there is still to emerge online-only news desks – what you have are those involved more in the commercial processes than news gathering and dissemination. Further, there is also the challenge of speed – you do things at a breakneck pace, you are bound to get something wrong, thus affect good journalism. For most Indian publishing, the dawning of the online son is flawed not because they don't have long-term goals but because they are still at loggerheads to introduce what’s best in the short-term.

But media in India has shown enough resilience till now to survive across platforms. And there’s cohesion still in the offing. The churnings are on, so is the transition, thus good times for journalism are yet to come, when possibilities will be fullest, understanding user-habits the best, and the consumption experience the best.

In other words, online media in India has charted the right route. It's only a matter of time when it gets there.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

You May Also Like

HT Media posts Consolidated Total Revenue of Rs 580 crore in Q2

Chairperson and Editorial Director Shobhana Bhartia says due to lower commodity prices and control on costs there has been an improvement in operating profit

HT Media has posted a Consolidated Total Revenue for Q2, 2020 at Rs 580 crore.

As per a statement released by the company, EBITDA for Q2’20 increased by 139%, and margins at 14% vis-à-vis 6% in previous year. This has been driven by softening of newsprint prices and continued focus on cost.

The Net Cash position at a consolidated level continues to be strong.

The Print ad revenue has declined due to sluggish volumes, even as yields have improved. National advertising continues to be soft, although local advertising witnessed growth.

Savings in raw material costs have driven improvement in EBITDA margins.

Chairperson and Editorial Director Shobhana Bhartia said, “Slowing economic growth has hit advertising spends in key categories, putting pressure on revenues across the media industry. As a result, our Print and Radio (on like to like basis) businesses saw revenues dip as compared to a year-ago. However, thanks to lower commodity prices and a tight control on costs, we saw an improvement in our operating profit. On the digital front, Shine, our online recruitment portal has shown good progress and continues to grow. Our outlook for the coming quarter remains cautious, given overall economic sentiment and macroeconomic trends. Cost-control and falling commodity prices should help protect our margins.”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

ABP Group posts Rs 15.70 crore as net profit in Q1 FY20

The group’s total operating income stands at Rs 365.55 crore

ABP Group has posted a net profit of Rs 15.70 crore in the first quarter of FY20, as per media reports.

The group’s total operating income stands at Rs 365.55 crore.

It’s net profit for the fiscal ended March 31, 2019, was down 68% to Rs 31.90 crore compared to the previous fiscal.

The Profit Before Interest Lease Depreciation and Tax (PBILDT) has also dropped 53.52% to Rs 107.12 crore.

The group has six news channels - ABP News (Hindi), ABP Ananda (Bengali) ABP Majha (Marathi) and ABP Asmita (Gujarati), ABP Sanjha (Punjabi) and ABP Ganga (Hindi).

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Zee Media posts consolidated revenue of Rs 137.03 crore for Q2 FY20

ZMCL has recorded 4.4% growth in operating revenue for first half of FY20

Zee Media Corporation Ltd (ZMCL) has posted a 4.4 per cent growth in operating revenue to Rs 337.6 crore in the first half of FY20, as per media reports.

It has reported a consolidated revenue of Rs 137.03 crore for Q2 FY20.

In a statement, ZMCL has said: “During the quarter, the network expanded its footprint s into Southern India through the launch of Zee Hindustan in Tamil and Telugu languages. This is intended to make the network's content accessible to wider audience.”

The operating expenditure in Q2FY20 has dropped by 21.7 per cent.

The statement further said: “EBITDA for HlFY20 improved by 34.1 per cent to Rs 1,029 million from Rs 767.5 million EBITDA for H1FY19, while the same declined by 9.4 per cent to Rs 370.2 million from Rs 408.7 million for the corresponding period last financial year. EBITDA Margin grew from 23.7 per cent in H1FY19 to 30.5 per cent in HlFY20, while growing from 24.2 per cent in Q2FY19 to 27 per cent in Q2FY20.”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

No slowdown here: In-cinema ad rates up by at least 50% for 3 big Diwali releases

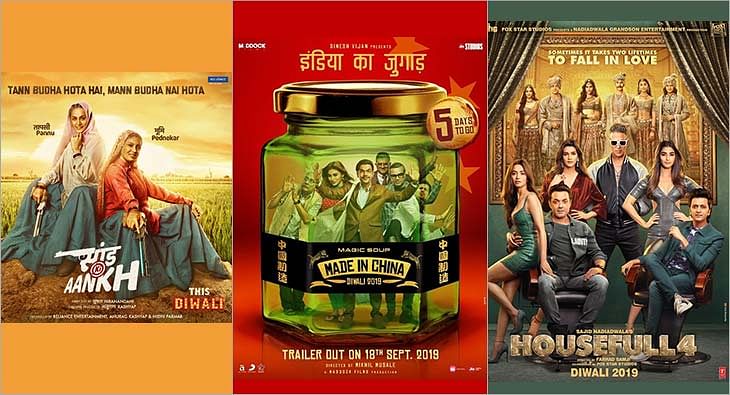

Housefull 4, Made In China and Saand Ki Aankh ready to hit the silver screen this week, with the hopes of giving brands the eyeballs they look for in theatres

It’s that time of the year again when theatres gear up to pocket maximum gains. Diwali is here and there are three films ready to hit the silver screen this week--Housefull 4, Made In China and Saand Ki Aankh. The festive period brings much joy to exhibitors, distributors and theatre owners because it ensures footfalls, giving brands the eyeballs they look for. In fact, industry experts don’t feel that economic slowdown this year has impacted in-cinema advertising. While they are concerned about three movies clashing during Diwali, they predict 50-100 per cent rise in ad rates during this period.

Advertising moolah

Mohan Umrotkar, CEO, Carnival Cinemas, is expecting 60-70 per cent surge in advertisement topline compared to last year. “Going by the buzz and advance booking for these three releases, market is bullish. Advertisers have blocked most of the advt-slots during the festival period. Housefull 4, Made In China and Saand Ki Aankh all combined together should generate around Rs 350 crore topline at the box office during the festival week. We are expecting 60-70 per cent surge in the advertisement topline from last year. Also, this year we have added around 14 per cent new advertisers, and 4 per cent of them are first-time cinema advertisers,” he says.

But according to Siddharth Bhardwaj, Chief Marketing Officer - Head of Enterprise Sales, UFO Moviez, things have changed a lot in the last couple of years. “Since some films have not really lived up to their expectation, advertisers are spreading the spends all through the year. They are picking up far more number of titles in the year rather than focusing only on Diwali or Eid.”

“It is good for the industry because you can monetise the inventories beyond just big weeks. A lot of content- driven films have come up which has given us the opportunity to monetise more markets. It has put lesser pressure on Diwali. Most of the cinemas are sold out for Diwali. It becomes difficult to accommodate everything,” Bharadwaj opines. He also reveals that for this week, the inventories are already full.

Diwali ad rates

Experts reveal that ad rates differ from property to property and depends on location as well. But Diwali surely sees a massive hike in rates. This year, theatre owners are expecting 100 per cent rise in ad rates. While Umrotkar revealed that for Diwali, they are charging 100 per cent higher than the regular card rates, Girish Johar, trade analyst and film producer, shared that even the rates for putting up kiosks of brands go up during festivals like Diwali.

“It’s based on property. On a ballpark, ad rates double up. So if you are putting up a kiosk, they charge say Rs 50,000-25,000 for a month. During Diwali, they charge almost double because of the kind of footfalls theatres witness,” Johar revealed.

Economic slowdown? Not for Cinema!

This year, brands have been pulling back their spends on other mediums due to economic slowdown, but cinema seems unaffected. Calling entertainment business recession-proof, Johar explains, “If you see the other side, box office is up by 15-20 per cent. Yes, it is a bit subdued because the brands are in a wait-and- watch scenario. They are increasing their focus around consumption rather than awareness.”

Bharadwaj too seconded it by saying, “These are challenging times but our medium is very efficient. If you see economy has slowed down, but the cinema has grown instead.”

Clash cover

Three movies are clashing this Diwali which means shared screens and box office gains.

“It’s never good for us when two or more big-ticket films release together. If they would have come on different dates, there are chances that more advertisers will take advt. inventory in those weeks separately instead of that one particular week,” shares Umrotkar.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

INOX Leisure Ltd sees 42% growth in total revenue

Profit After Tax up 327% to Rs 51 crore

INOX Leisure Ltd (INOX) has reported financials for the second quarter ending September 2019.

Its total revenue has risen to Rs 524 crore with a 42% growth from Rs 369 crore in the corresponding quarter in FY19. Its EBITDA has more than doubled to Rs 107 crore with a 121% growth, while the PAT stood at an impressive Rs 51 crore, up 327% from previous year’s second quarter.

Siddharth Jain, Director, INOX Group, said: “At INOX, setting new benchmarks is now a routine, thanks to our consistently sharp focus on luxury, service and technology and our uncompromised desire to offer our patrons, nothing but the latest and the best! We are delighted with our remarkable consistency on all parameters, and we are sure about maintaining the momentum and focus on innovativeness. Content once again proved that why we term it as the ‘hero’. Thanks to the creators of such spellbinding movies, which keep inviting our guests to our properties, and allowing us to pamper them with our signature hospitality. With the launch of Megaplex, we are delighted to further our endeavor of developing experience-driven cinema destinations of global standards, and we will continue to do so. On behalf of Team INOX, I assure all our stakeholders that we will continue to break barriers and exceed all expectations.”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Hathway Cable & Datacom reports 100% subscription collection efficiency in Q2

The broadband subscriber base has increased from the previous quarter’s 840,000 to 860,000

Hathway Cable and Datacom has reported subscription collection efficiency at 100%, and the broadband subscriber base has increased from previous quarter’s 840,000 to 860,000 in quarter ending September, as per media reports.

It has narrowed its consolidated net loss by 74% and the operating EBITDA has been reported 15% up to Rs 107.5 crore compared to Rs 93.1 crore a quarter ago.

The total income has dropped 2%, while the expenditure is down 6%.

In the financial results, the company has said the FTTH markets are leading growth in customer acquisition.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

ZEEL posts 7.4% YoY growth in total revenue for Q2 FY20

ZEEL's domestic advertising revenue has grown 1.4% YoY in Q2FY20

Zee Entertainment Enterprises Limited (ZEEL) has reported a consolidated revenue of Rs 2,122 crore for the second quarter of FY20, recording a growth of 7.4% on YoY basis.

The Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) was recorded as Rs 692.9 crore with an EBITDA margin of 32.7%. PAT for the quarter was Rs 413.2 crore. The Profit After Tax (PAT) for the quarter was Rs 413.2 million, with a growth of 6.9% YoY.

During the second quarter, ZEEL’s consolidated advertising revenue grew by 1.2% YoY to Rs 1,224.7 crore. The domestic advertising revenues grew by 1.4% YoY to Rs 1169 crore.

ZEEL has posted 26.8% YoY growth in Q2FY20 domestic subscription revenue. ZEEL’s consolidated subscription revenue grew by 19.0% to Rs 723.5 crore during the quarter.

ZEEL’s total expenditure in Q2FY20 stood at Rs 1429.1 crore, higher by 9.9% YoY compared to Q2FY19.

While ZEE5 recorded a peak DAU (Daily Active User) base of 8.9 million in September 2019, ZEE5 users watched an average of 120 minutes of content on the platform in the same month.

During Q2 FY20, the television network had an all-India viewership share of 18.4%.

During the quarter, ZEEL’s international business revenue was Rs 208.2 crore. The advertising and subscription revenues for international business declined by 4.0% YoY and 21.5% YoY, respectively.

Zee Music Company has registered 7.1 billion views on YouTube in Q2.

Punit Goenka, Managing Director and CEO, ZEEL, said, “I am pleased with the performance we have exhibited during the quarter. Our entertainment portfolio continues to grow from strength to strength across all formats and maintained its leading position. Our television network has emerged stronger post the implementation of tariff order on the back of a strong customer connect and brand pull of its channels. ZEE5 continued to gain traction across audience segments and markets, driven by its compelling content library and expanding list of partnerships across the digital eco-system. This strong operating performance allowed us to deliver industry leading growth in both advertising and subscription despite the tough macro-economic environment. Domestic subscription growth of 27% has reaffirmed the value proposition our television network has built over the years. The impact of tariff order has now largely settled down and has brought increased transparency along with improved monetization. Our domestic advertising revenue growth, though significantly lower than historical trend, is higher than the industry growth. We have witnessed an improvement in ad spends through the quarter and we believe that the onset of festive season along with measures taken by the government will help revive the consumption growth.”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Share

Share