Guest ColumnRetrofit: The curious case of a clarification

Media runs on trust. The reader or viewer believes what he sees or reads and treats it like gospel. Media has to be responsible at all times in what it puts out. The increasing clutter in media and its resultant competitive edge is proving a damper, for it means that people take short cuts, observes veteran journalist Sandeep Bamzai.

A clarification appeared on page 1 of Economic Times on the morning of September 15, strangely the anniversary of the Lehman Brothers blowout. I would like to reproduce the clarification because it has great import and in many ways typifies the malaise in Indian journalism. The ET clarification read – ICICI Bank has clarified that the aggregate net non-performing home loans sold by it to asset reconstruction company ARCIL since its inception is less than Rs 1,500 crore, instead of the Rs 10,000 crore mentioned in an ET article published on September 13. The bank has also pointed out that fraud was detected only in the case of five loan accounts, which together came to less than Rs 1 crore, a tiny percentage of the total. Separately, the Secretary of the Institute of Chartered Accountants of India (ICAI) has clarified that the President of his organisation has not asked the Central bank to audit assets sold to ARCIL.

Interesting clarification boxed on Page 1 of ET. Curious that it puts the onus of the clarification on ICICI and ICAI. Yes, the story appeared in ET, but there is no remorse, not so much as a by your leave about ET’s own culpability in what appears to be a monumental judgmental error. Nowhere does it say that ET apologises for carrying the said story, which obviously worked to Brand ICICI’s detriment. Bah, it did seem a bit odd. First, the misdemeanour and then not even a sorry. Even last year, in the immediate aftermath of the Lehman, Fannie Mae, Freddie Mac fiascos, speculation was rife in Mumbai’s financial markets that ICICI was in trouble. Murmurs persisted and ICICI’s stock price took a massive hit. The management came on various television channels to tell the world at large that all was well. But suspicions lingered. After all, ICICI Bank is India’s largest and most aggressive private sector bank. It could not be allowed to fail. Over time, one realised that the bank was in the pink of heath and it was business as usual thereafter.

Fade to black.

Now, I take you to ICICI’s page 1 advertisement in the same ET and ToI on the morning of September 14. It was an unprecedented step, putting out a quarter page ad on page 1 of ET and ToI. Although, I must add that these days clarifactory adverts from corporates are the flavour of the season, given that ADAG ran a series of them nailing the Petroleum Ministry’s lies. Now, I would like to reproduce parts of the advertisement – A newspaper carried a baseless article on September 13, 2009, suggesting that the ICAI has asked the RBI to re-audit sale of loans by ICICI Bank to ARCIL. What is perhaps most pertinent and damaging is the last line in bold which says – The news item appears to be a deliberate and malicious plant aimed at damaging the Bank’s reputation. The Bank is taking up this matter with regulatory and law enforcement authorities. These are strong words. It is believed that ICICI thinks that these sabotage attempts are being made by corporate rivals. In this hotstepping information age, any such story or rumour can act as a catalyst for a coordinated market operation, where operators sense the possibility of making some quick bucks. Last year, ICICI Bank had approached RBI and SEBI for a probe into the brutal hammering down of its share price by what it called a ‘vested interest’. We still don’t know who the culprit was, but can hazard an educated guess. Nothing more. This time the story appeared on a Sunday, when the stock markets are shut, so blood-letting on the counter was avoided.

During the crisis in Singur, Ratan Tata had made similar allegations against a corporate rival stoking fires or fishing in troubled waters. However, it wasn’t clear as to who was behind the move or instigation. Of course, one had hazarded an educated guess then as well, which brings me to the regulator, what is it doing?

Corporate rivalry is nothing new in India. The ongoing gas opera between the Ambani brothers is a case in point. The way NTPC, which was lying somnolent for most part, has suddenly moved into the scrap is most interesting as it tries to protect its rights and interests in the matter. But this has only happened after ADAG, owned by Anil Ambani, ran a series of controversial ads in 33 national and regional dailies, highlighting how Reliance Industries and the Petroleum Ministry was trying to short change the public sector power utility.

But back to ICICI’s alleged dud loans, which ET wanted to throw into stark relief. Every banking and financial institution runs on trust. When there is a trust deficit between the institution and the customer, that’s when problems begin. Overwhelming greed, nay avarice, in corporate America was partly responsible for the collapse of the five iconic investment banks and other institutions, triggering a global meltdown hitherto not seen in modern times. The other more important part was a trust deficit. When customers start thinking negatively about their bank or any other financial institution that they have dealings with – insurance company, brokerage, depository, et al – that is the beginning of the end. This is also when runs take place on banks.

Similarly media, too, runs on trust. The reader or viewer believes what he sees or reads and treats it like gospel. Media has to be responsible at all times in what it puts out. The increasing clutter in media and its resultant competitive edge is proving a damper, for it means that people take short cuts or are malleable and ductile to accept ‘plants’. I hope only plants are accepted and nothing else in lieu of it. These plants, as ICICI has stated in its advert, are aimed at eroding and maligning reputations and could have long term ramifications for the people or entities involved. I am amazed that while ET did put out a clarification a day after the ICICI advert, it never bothered to accept or fix responsibility. It chose to word its clarification in such a manner as if ICICI has clarified and not ET. Not even an admission of guilt, not even a ‘the error is regretted’. Did it mean that they were standing by their story and were only willing to carry ICICI Bank’s clarification under extreme duress? Was there more to it then? People have speculated long and hard about ICICI’s loan portfolio. But nothing concrete has ever come out of it. So, in totality, it was a truly shameful show of not accepting wrong and portraying a wrong as right. In ET’s specific case, it cannot be that two or more wrongs make a right. I cannot believe for a moment that it was a systemic failure this time.

What were the gatekeepers doing even as the reporter was filing the malafide story? What was the desk or the editor doing? Did they take a call on the story in this sorry episode? I tried to access the story by ET Bureau writer Anand Rawni, but found that the story had been pulled out. The legend that greeted me was – ‘Page not found’.

Lost in translation, but only after the damage was done. Nobody remembers the clarification, people only remember the story. Therein lies the rub.

(Sandeep Bamzai is a well-known journalist, who started his career as a stringer with The Statesman in Kolkata in 1984. He has held senior editorial positions in some of the biggest media houses in three different cities - Kolkata, Mumbai and New Delhi. In late 2008, he joined three old friends to launch a start-up – Sportzpower Network – which combines his two passions of business and sport. Familiar with all four media – print, television, Internet and radio, Bamzai is the author of three different books on cricket and Kashmir.

The views expressed here are of the writer’s and not those of the editors and publisher of exchange4media.com.)

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

You May Also Like

HT Media posts Consolidated Total Revenue of Rs 580 crore in Q2

Chairperson and Editorial Director Shobhana Bhartia says due to lower commodity prices and control on costs there has been an improvement in operating profit

HT Media has posted a Consolidated Total Revenue for Q2, 2020 at Rs 580 crore.

As per a statement released by the company, EBITDA for Q2’20 increased by 139%, and margins at 14% vis-à-vis 6% in previous year. This has been driven by softening of newsprint prices and continued focus on cost.

The Net Cash position at a consolidated level continues to be strong.

The Print ad revenue has declined due to sluggish volumes, even as yields have improved. National advertising continues to be soft, although local advertising witnessed growth.

Savings in raw material costs have driven improvement in EBITDA margins.

Chairperson and Editorial Director Shobhana Bhartia said, “Slowing economic growth has hit advertising spends in key categories, putting pressure on revenues across the media industry. As a result, our Print and Radio (on like to like basis) businesses saw revenues dip as compared to a year-ago. However, thanks to lower commodity prices and a tight control on costs, we saw an improvement in our operating profit. On the digital front, Shine, our online recruitment portal has shown good progress and continues to grow. Our outlook for the coming quarter remains cautious, given overall economic sentiment and macroeconomic trends. Cost-control and falling commodity prices should help protect our margins.”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

ABP Group posts Rs 15.70 crore as net profit in Q1 FY20

The group’s total operating income stands at Rs 365.55 crore

ABP Group has posted a net profit of Rs 15.70 crore in the first quarter of FY20, as per media reports.

The group’s total operating income stands at Rs 365.55 crore.

It’s net profit for the fiscal ended March 31, 2019, was down 68% to Rs 31.90 crore compared to the previous fiscal.

The Profit Before Interest Lease Depreciation and Tax (PBILDT) has also dropped 53.52% to Rs 107.12 crore.

The group has six news channels - ABP News (Hindi), ABP Ananda (Bengali) ABP Majha (Marathi) and ABP Asmita (Gujarati), ABP Sanjha (Punjabi) and ABP Ganga (Hindi).

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Zee Media posts consolidated revenue of Rs 137.03 crore for Q2 FY20

ZMCL has recorded 4.4% growth in operating revenue for first half of FY20

Zee Media Corporation Ltd (ZMCL) has posted a 4.4 per cent growth in operating revenue to Rs 337.6 crore in the first half of FY20, as per media reports.

It has reported a consolidated revenue of Rs 137.03 crore for Q2 FY20.

In a statement, ZMCL has said: “During the quarter, the network expanded its footprint s into Southern India through the launch of Zee Hindustan in Tamil and Telugu languages. This is intended to make the network's content accessible to wider audience.”

The operating expenditure in Q2FY20 has dropped by 21.7 per cent.

The statement further said: “EBITDA for HlFY20 improved by 34.1 per cent to Rs 1,029 million from Rs 767.5 million EBITDA for H1FY19, while the same declined by 9.4 per cent to Rs 370.2 million from Rs 408.7 million for the corresponding period last financial year. EBITDA Margin grew from 23.7 per cent in H1FY19 to 30.5 per cent in HlFY20, while growing from 24.2 per cent in Q2FY19 to 27 per cent in Q2FY20.”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

No slowdown here: In-cinema ad rates up by at least 50% for 3 big Diwali releases

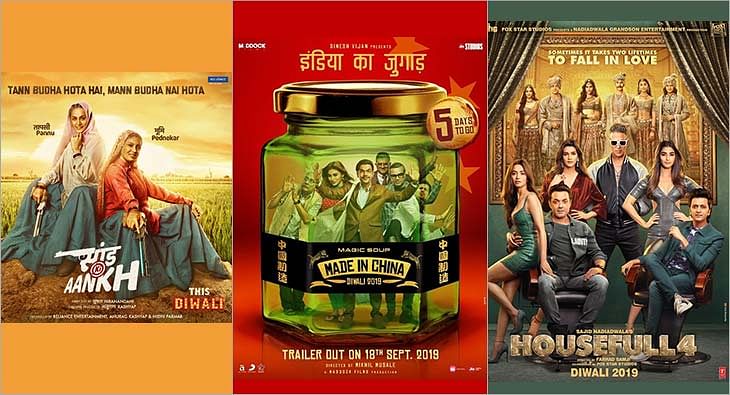

Housefull 4, Made In China and Saand Ki Aankh ready to hit the silver screen this week, with the hopes of giving brands the eyeballs they look for in theatres

It’s that time of the year again when theatres gear up to pocket maximum gains. Diwali is here and there are three films ready to hit the silver screen this week--Housefull 4, Made In China and Saand Ki Aankh. The festive period brings much joy to exhibitors, distributors and theatre owners because it ensures footfalls, giving brands the eyeballs they look for. In fact, industry experts don’t feel that economic slowdown this year has impacted in-cinema advertising. While they are concerned about three movies clashing during Diwali, they predict 50-100 per cent rise in ad rates during this period.

Advertising moolah

Mohan Umrotkar, CEO, Carnival Cinemas, is expecting 60-70 per cent surge in advertisement topline compared to last year. “Going by the buzz and advance booking for these three releases, market is bullish. Advertisers have blocked most of the advt-slots during the festival period. Housefull 4, Made In China and Saand Ki Aankh all combined together should generate around Rs 350 crore topline at the box office during the festival week. We are expecting 60-70 per cent surge in the advertisement topline from last year. Also, this year we have added around 14 per cent new advertisers, and 4 per cent of them are first-time cinema advertisers,” he says.

But according to Siddharth Bhardwaj, Chief Marketing Officer - Head of Enterprise Sales, UFO Moviez, things have changed a lot in the last couple of years. “Since some films have not really lived up to their expectation, advertisers are spreading the spends all through the year. They are picking up far more number of titles in the year rather than focusing only on Diwali or Eid.”

“It is good for the industry because you can monetise the inventories beyond just big weeks. A lot of content- driven films have come up which has given us the opportunity to monetise more markets. It has put lesser pressure on Diwali. Most of the cinemas are sold out for Diwali. It becomes difficult to accommodate everything,” Bharadwaj opines. He also reveals that for this week, the inventories are already full.

Diwali ad rates

Experts reveal that ad rates differ from property to property and depends on location as well. But Diwali surely sees a massive hike in rates. This year, theatre owners are expecting 100 per cent rise in ad rates. While Umrotkar revealed that for Diwali, they are charging 100 per cent higher than the regular card rates, Girish Johar, trade analyst and film producer, shared that even the rates for putting up kiosks of brands go up during festivals like Diwali.

“It’s based on property. On a ballpark, ad rates double up. So if you are putting up a kiosk, they charge say Rs 50,000-25,000 for a month. During Diwali, they charge almost double because of the kind of footfalls theatres witness,” Johar revealed.

Economic slowdown? Not for Cinema!

This year, brands have been pulling back their spends on other mediums due to economic slowdown, but cinema seems unaffected. Calling entertainment business recession-proof, Johar explains, “If you see the other side, box office is up by 15-20 per cent. Yes, it is a bit subdued because the brands are in a wait-and- watch scenario. They are increasing their focus around consumption rather than awareness.”

Bharadwaj too seconded it by saying, “These are challenging times but our medium is very efficient. If you see economy has slowed down, but the cinema has grown instead.”

Clash cover

Three movies are clashing this Diwali which means shared screens and box office gains.

“It’s never good for us when two or more big-ticket films release together. If they would have come on different dates, there are chances that more advertisers will take advt. inventory in those weeks separately instead of that one particular week,” shares Umrotkar.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

INOX Leisure Ltd sees 42% growth in total revenue

Profit After Tax up 327% to Rs 51 crore

INOX Leisure Ltd (INOX) has reported financials for the second quarter ending September 2019.

Its total revenue has risen to Rs 524 crore with a 42% growth from Rs 369 crore in the corresponding quarter in FY19. Its EBITDA has more than doubled to Rs 107 crore with a 121% growth, while the PAT stood at an impressive Rs 51 crore, up 327% from previous year’s second quarter.

Siddharth Jain, Director, INOX Group, said: “At INOX, setting new benchmarks is now a routine, thanks to our consistently sharp focus on luxury, service and technology and our uncompromised desire to offer our patrons, nothing but the latest and the best! We are delighted with our remarkable consistency on all parameters, and we are sure about maintaining the momentum and focus on innovativeness. Content once again proved that why we term it as the ‘hero’. Thanks to the creators of such spellbinding movies, which keep inviting our guests to our properties, and allowing us to pamper them with our signature hospitality. With the launch of Megaplex, we are delighted to further our endeavor of developing experience-driven cinema destinations of global standards, and we will continue to do so. On behalf of Team INOX, I assure all our stakeholders that we will continue to break barriers and exceed all expectations.”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Hathway Cable & Datacom reports 100% subscription collection efficiency in Q2

The broadband subscriber base has increased from the previous quarter’s 840,000 to 860,000

Hathway Cable and Datacom has reported subscription collection efficiency at 100%, and the broadband subscriber base has increased from previous quarter’s 840,000 to 860,000 in quarter ending September, as per media reports.

It has narrowed its consolidated net loss by 74% and the operating EBITDA has been reported 15% up to Rs 107.5 crore compared to Rs 93.1 crore a quarter ago.

The total income has dropped 2%, while the expenditure is down 6%.

In the financial results, the company has said the FTTH markets are leading growth in customer acquisition.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

ZEEL posts 7.4% YoY growth in total revenue for Q2 FY20

ZEEL's domestic advertising revenue has grown 1.4% YoY in Q2FY20

Zee Entertainment Enterprises Limited (ZEEL) has reported a consolidated revenue of Rs 2,122 crore for the second quarter of FY20, recording a growth of 7.4% on YoY basis.

The Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) was recorded as Rs 692.9 crore with an EBITDA margin of 32.7%. PAT for the quarter was Rs 413.2 crore. The Profit After Tax (PAT) for the quarter was Rs 413.2 million, with a growth of 6.9% YoY.

During the second quarter, ZEEL’s consolidated advertising revenue grew by 1.2% YoY to Rs 1,224.7 crore. The domestic advertising revenues grew by 1.4% YoY to Rs 1169 crore.

ZEEL has posted 26.8% YoY growth in Q2FY20 domestic subscription revenue. ZEEL’s consolidated subscription revenue grew by 19.0% to Rs 723.5 crore during the quarter.

ZEEL’s total expenditure in Q2FY20 stood at Rs 1429.1 crore, higher by 9.9% YoY compared to Q2FY19.

While ZEE5 recorded a peak DAU (Daily Active User) base of 8.9 million in September 2019, ZEE5 users watched an average of 120 minutes of content on the platform in the same month.

During Q2 FY20, the television network had an all-India viewership share of 18.4%.

During the quarter, ZEEL’s international business revenue was Rs 208.2 crore. The advertising and subscription revenues for international business declined by 4.0% YoY and 21.5% YoY, respectively.

Zee Music Company has registered 7.1 billion views on YouTube in Q2.

Punit Goenka, Managing Director and CEO, ZEEL, said, “I am pleased with the performance we have exhibited during the quarter. Our entertainment portfolio continues to grow from strength to strength across all formats and maintained its leading position. Our television network has emerged stronger post the implementation of tariff order on the back of a strong customer connect and brand pull of its channels. ZEE5 continued to gain traction across audience segments and markets, driven by its compelling content library and expanding list of partnerships across the digital eco-system. This strong operating performance allowed us to deliver industry leading growth in both advertising and subscription despite the tough macro-economic environment. Domestic subscription growth of 27% has reaffirmed the value proposition our television network has built over the years. The impact of tariff order has now largely settled down and has brought increased transparency along with improved monetization. Our domestic advertising revenue growth, though significantly lower than historical trend, is higher than the industry growth. We have witnessed an improvement in ad spends through the quarter and we believe that the onset of festive season along with measures taken by the government will help revive the consumption growth.”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Share

Share