The marketing of luxury brands

The market for luxury brands in our country has expanded in recent times. With income levels going up, customers prepared to buy such brands are growing in numbers. Retail management company KSA Technopak estimates the market for luxury and high-end clothing in India at Rs 1,000 crore and for accessories at another Rs 1,000 crore.

The market for luxury brands in our country has expanded in recent times. With income levels going up, customers prepared to buy such brands are growing in numbers. According to an NCAER Household Income Survey, in 2001-02, there were 20,000 families in India with annual incomes of more than Rs 1 crore. By 2005, that number is expected to increase to 53,000. By 2010, India will have some 1,40,000 crorepatis. Retail management company KSA Technopak estimates the market for luxury and high-end clothing in India at Rs 1,000 crore and for accessories at another Rs 1,000 crore.

In the past, brands like Liz Claiborne and Pierre Cardin tested Indian waters but made a hasty retreat following poor customer response. This led to a general perception that India is still not ready for luxury brands. But now that impression is changing. Many leading global luxury brand marketers have started taking our market seriously.

Luxury, derived from the Latin word luxus, means indulgence of the senses, regardless of cost. Luxury brands are brands whose ratio of functional utility to price is low while that of intangible utility to price is high. Such brands share characteristics like consistent premium quality, a heritage of craftsmanship, a recognisable style or design, a limited production run of any item to ensure exclusivity, an element of uniqueness and an ability to keep coming up with new designs when the category is fashion-intensive.

Luxury goods' marketing is a different ball game as the type of customers involved fall in a different class altogether. These customers are influenced more by glamour and style and want to stand out in a crowd. They do not bat an eyelid whey they buy a Vuitton bag costing Rs 50,000 or a Mont Blanc diamond-encrusted pen for Rs 50 lakh, Ermenegildo Zegna's top-of the-line, custom-tailored suit costing Rs 6 lakh or a mid-range Louis Vuitton briefcase priced Rs 1.27 lakh.

As these figures suggest, luxury brands are prestige products characterised by high-involvement decision-making that is strongly related to the person's self-concept. Sensory gratification and social approval are the primary factors in selecting a prestige product. Cutting prices or giving discounts can be detrimental in case of luxury brands. A higher price implies a higher level of quality and also suggests a certain degree of prestige. Similarly, distribution should be restricted. Status-sensitive consumers may reject a particular product if the feeling of exclusivity goes away.

Managing luxury brands is as much an art as a science. The challenge is to create a demand for something which is not really needed. After all, it looks crazy to spend Rs 50,000 on a handbag or Rs1,27,000 on a briefcase. Creativity plays a key role in creating such a premium image. Many luxury brands achieve legitimacy and fashion authority as a result of the creative talent of their design teams who respect the brand heritage and yet continuously reinvent it.

Brand-building is a different ball game in case of luxury goods. Fashion shows, special events, and other public relations efforts must be carefully coordinated to convey the desired image. The magazines selected for advertising are often unconventional and trend-setting. It is the kind of people who read them, not the numbers, which matter. The movies in which the brand appears and the celebrities and pop icons who endorse the brand must also be selected carefully.

The product line decisions in case of luxury brands are somewhat tricky. First, to what extent should companies include in their lines lower-priced accessory items to target a broader market? A second and related issue is whether there should be line extensions beyond the core category. Such a strategy may make operations more complex and drive up costs. Moreover, transferring the brand's fashion authority from the core to another category may not be as simple as it sounds. Despite these concerns, most successful designerwear luxury brands combine a risky and perishable ready-to-wear offering with sales of less fashion-intensive items, such as leather accessories. A Gucci store might display its latest fashion accessories prominently but generate most of its sales from black and brown handbags and conservative silk ties. Many luxury brands realise less than 25 per cent of their sales from ready-to-wear products. The balance comes from fragrances, leather accessories, and home furnishings.

Channel management issues are again different for luxury brands. Here the focus is not on expanding reach. Indeed, marginal and unfocused retailers must be dropped from time to time to improve the strength of the brand franchise for those remaining. Investment in flagship monobrand stores augments the brand's prestige and presents it as a lifestyle concept.

In the past, customer service for luxury brands meant making to order. Craftsmanship and customisation went hand-in-hand. Today exclusivity is provided not by customisation but by restricted supply. But selective distribution and limited assortments cause inconvenience to consumers. So many luxury brands are looking at new ways of improving customer service.

Traditionally, luxury brand retailers have not paid much attention to computerising records of transactions with clients. Now they are realising the importance of customer relationship management for various reasons. Customers who buy an accessory today may purchase higher-value items tomorrow. The tourist who buys a single item from one store may buy items of the same brand in other stores around the world. Databases enable retailers to know how important their customers are, no matter which store they may shop in, around the world. Customer databases enable owners to contact their consumers with invitations to collection previews, end-of-season sales and other events. Customer databases also ensure that even when salespeople leave, their knowledge is not lost.

Many of the points discussed so far are exemplified by the French luxury goods conglomerate LVMH which owns several famous brands in various product categories: wines and spirits (Dom Pérignon, Moët & Chandon, Veuve Clicquot and Hennessy), perfumes (Christian Dior, Guerlain and Givenchy), cosmetics (Bliss, Fresh and BeneFit), fashion and leather goods (Christian Lacroix, Donna Karan, Givenchy, Kenzo and Louis Vuitton), watches and jewellery (TAG Heuer, Ebel, Chaumet and Fred).

At the heart of LVMH's business model is a well-thought-out process for creating and growing star brands. According to Bernard Arnault, the CEO, star brands must be timeless, modern, fast growing and highly profitable.

A star brand has to be built for eternity. It must have been around for a long time. It should have become an institution. For example, Dom Perignon was created 250 years ago, but LVMH is confident it will be relevant and desired for another 100 years and beyond.

Timelessness takes years, even decades to develop. Such a brand must have come to stand for something in the eyes of the world. A star brand has to remain current and fashionable. It needs sex appeal and has to be modern. It has to be so new that people would want to buy it. A star brand has to keep growing. Growth is a clear signal that the brand has consumer appeal. Last but not the least, a star brand has to be profitable. Profitability depends on both the price and the costs incurred. So even in case of star brands, operational excellence is important. That means sourcing of raw materials, manufacturing and distribution must be efficient.

LVMH realises that in the case of luxury brands, the innovation supporting the creative process and the advertising are very expensive. High profitability can only come with discipline in the manufacturing process. This discipline includes a tremendous emphasis on quality and productivity. For example, Vuitton's manufacturing is labour-intensive, with a team of 24 workers producing about 120 handbags a day. The manufacturing process is carefully planned and executed with modern technology. LVMH analyses how to make each part of the product, and from where to buy each part. It finds the best leather at the best price and gives it the treatment it needs. A single purse can have up to 1,000 manufacturing tasks. LVMH plans each of these steps carefully.

The Boulogne Multicolor, a shoulder bag that went on sale in 2004 in Vuitton stores worldwide for about $1,500, illustrates how LVMH coordinates its operations. With the success of the Murakami line in 2003, Vuitton's marketing executives quickly began looking for a way to capitalise on it. They learnt from store managers that there was latent customer demand for a shoulder bag. In a workshop attached to the marketing department, technicians took a classic bag, the Boulogne, reworked it in multicolored toile, added metal studs and other touches, and named it the Boulogne Multicolor. The prototype went directly from the marketing department to top executives, who approved the bag without any involvement by the design team. In June, the prototype reached Vuitton's factory in Ducey.

When LVMH opened its first store in Delhi last year, it found strong demand for its premium, aspirational products. According to LVMH sources, the major reason for the success was the simultaneous launch of products and services in flagship stores in Paris and India. This earned LVMH the trust of discerning Indian consumers.

LVMH's experience is clear evidence that the super rich of the world, irrespective of which country they belong to, have similar lifestyles, tastes and aspirations. They want the best and the latest in fashion. At many big social functions today in the country, it is not uncommon to see women carrying Vuitton's Theda or Monogram Ambre handbags.

LVMH planned its entry carefully after spending sufficient time trying to understand the Indian market. The company closely monitored Indians who were buying abroad. This gave the company a good feel for how the market worked. Now LVMH has plans to launch other brands like Fendi, Dior and Celine for Indian customers. The company has also started introducing products from the spirits division ranging from Moët & Chandon champagne to Hennessy cognac and the recently launched luxury vodka Belvedere that retails for Rs 2,000 a bottle.

Developing luxury brands involves heavy investment of time, effort and money. That needs a different kind of mindset which is generally lacking in many Indian companies who look for quick returns. That is why there are few Indian luxury brands. But for those who are willing to take the plunge and wait patiently for the results to come, there is a pot of gold waiting at the end of the rainbow.

The author is Dean, Institute of Chartered Financial Analysts of India (ICFAI).

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Social Beat wins SEO mandate of Tata CLiQ tag rss

The account was won after a multi-agency pitch

e4m e4m Social Beat has won the SEO mandate for Tata CLiQ, one of the fastest-growing omnichannel marketplace in India. Social Beat has been entrusted with optimizing existing content, as well as launching new, optimized category pages systematically on Tata CLiQ’s platform to scale monthly organic traffic by 2x over the next year. The account was won after a multi-agency pitch and will be serviced by Social Beat’s offices in Mumbai.

Shishir Kataria, Director - Marketing, Tata CLiQ, “Shoppers, e-commerce or otherwise, continue to heavily rely on search and discovery throughout their shopping journey, be it engaging with the latest fashion trends or hunting for the best buys. No wonder a platform's ability to be a part of this journey organically drives significant consideration for it amongst potential shoppers. We, at Tata Cliq, are confident that Social Beat will help us develop and optimise content that is highly discoverable to grow our engagement and revenue. Our goal continues to be to drive more and more shoppers to our platform with optimised and curated products and relevant content.”

Vikas Chawla, Co-Founder, Social Beat said, “We are thrilled to partner with Tata CLiQ in their growth journey. We aim to scale traffic to the Tata CLiQ platform manyfold over the next year. Our team of specialised SEO and Content strategists will be working closely to achieve this”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

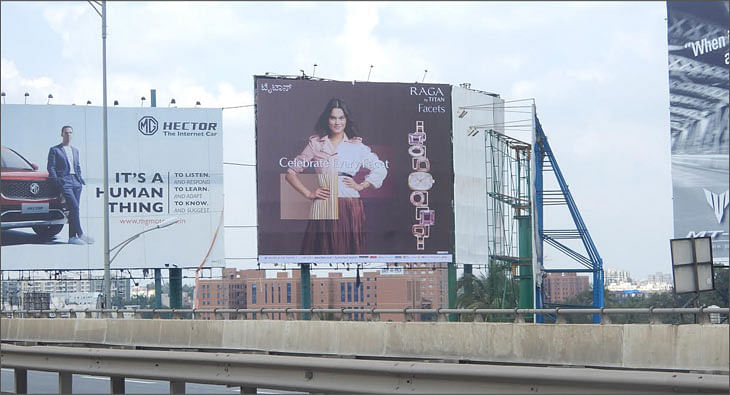

Will OOH dazzle this festive season?

As the celebrations begin, experts tell us the trends and challenges for the OOH sector this season

Be it the flower-clad taxis in Mumbai for Made in Heaven Season 2 promotion or Zomato’s ‘kheer mangoge kheer denge’ billboards, India's OOH advertising sector has undergone substantial transformation and expansion in the recent years. Even though the medium was severely hit during the pandemic years, it has now managed to rebuild its status. Now, with the onset of the festive season, elections and the cricket world cup, OOH is expected to see more and more advertisers come on board.

Amarjeet Hudda, Chief Operating Officer, Laqshya Media Group, believes most of the clients spend a lot of money during the festive season, especially for Durga Puja, Dussehra and Diwali, targeting their customers in a festive mood. The categories that spend heavily during these months are Auto, Consumer Durables, Real Estate, Organised retail, and E-commerce.

According to Dipankar Sanyal of Platinum Outdoor, there was a huge surge in the festive season last year, and he expects the same this year too. “Last four to five years have turbulent for outdoor. It was picking up in 2019, but then Covid came and everything went flat for two years,” he mentioned.

According to EY-FICCI’s M&E Report 2023, OOH media grew 86 percent in 2022 to Rs 37 billion. The value includes traditional, transit and digital media, but excludes untracked unorganised OOH media such as wall paintings, billboards, ambient media, storefronts, proxy advertising.

Sharing the brand’s perspective, Shivam Ranjan, Head of Marketing, Motorola-APAC, said, “We are going into this festive season with a strong mix of media, including OOH. Within OOH, we are focusing on digital OOH, due to its capability of programmatic serving, measurability, and near real-time insights that allow us to be agile with the communication and optimisation of our campaigns.”

With urbanisation, improved infrastructure, rising consumerism and an increased spending power, clients' expectations from OOH advertising too have evolved. “The clients expect better ROI on every investment, best in class innovations, tech-led planning and execution. Today, technology plays an important role starting from planning the campaign, to measuring metrics to ROI,” Singh explained.

Another trend that Sanyal has observed is that traditionally advertisers looked at spending on OOH nearly two weeks prior to the festivities, but now, most advertisers have now started advertising a week earlier so that they can get maximum eyeballs. Additionally, the digital OOH advertising (DOOH) has also emerged big. The digital OOH screens increased to around 100,000 and contributed eight percent of total segment revenues.

“Now with digital, there is more space for advertisers to come in one frame. Because of this, you can see it is getting more attractive. The innovations too are coming in at a much lower cost and creating a greater impact,” shared Sanyal.

The only challenge with the medium, according to Ranjan, is OOH being a fragmented industry with lack of measurability and agility. This becomes a serious issue for ROI-centric brands. However, the growth of DOOH, which is dynamic, agile and measurable, is giving marketers the confidence to invest in the medium backed by relevant data and outcomes.

Adding to this, Hudda highlighted that availability of good media spots is the biggest challenge in this season as media assets are limited and demand is very high. Due to the gap in the festive season, many clients are not able to fully optimise their campaigns. Rather sometimes, clients are even compelled to divert their budget which adversely impacts the industry, he shared.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Banking on positive consumer sentiment: BFSI optimistic on doubling festive AdEx : Cache

Some categories within the sector, however, may spend more in the quarter that follows the festive season

The BFSI sector is expecting a surge in demand for loan during the festive season and is looking at increasing its ad spends to cash in on the celebration spirit. Industry leaders say they are hopeful of witnessing a good growth in the number of applications for auto loan, home loan, credit card and health insurance during October, November and December due to positive consumer sentiment this year. However, though most of the BFSI players are planning to double their advertising budget this time compared to the previous year, there are some who are not investing too heavily on marketing during the festivals as they plan to save the money for the fourth quarter.

According to Shailendra Singh, MD & CEO, BOB Financial, they witness incremental growth every year during the October-December quarter, and they anticipate an increase in consumer spending as well as new enrolments for cards this year too. “There remains a surge in customer demand for credit during the festive season,” said Singh.

Singh shared that the company is fully geared up for the launch of #FestiveShoppingRewards on all Bank of Baroda credit card variants under the theme ‘Reimagine Festivities’. They would kickstart festive offerings with the start of Navratri.

The festive season does not just see the demand for credit go up, but there is an increase in applications for health and motor insurance too during this time of the year.

Aabhinna Suresh Khare, Chief Digital & Marketing Officer, BajajCapital Ltd, shared that among insurance products, health insurance and motor insurance reign supreme during festivals. According to Khare, the demand for mutual funds and SIPs too sees a hike.

“Overall, the festive season presents an opportune moment to secure insurance coverage. A plethora of attractive products and services are on offer, with financial institutions extending special discounts and promotions to entice new customers,” said Khare.

The company launched #BlessMeGanesha campaign during Ganesh Chaturthi. “Our goal for this festive season is not only to provide financial solutions but also to create memorable experiences and deepen the connection with our customers,” said Khare.

Though all major sectors spend heavily on advertising during the festive season, within the BFSI sector, some categories spend more in the quarter that follows the festive season.

Explaining the trend, Samir Sethi, Head of Brand Marketing, Policybazaar.com, said that the festive season has varying impacts on the BFSI sector. In the banking sector, for instance, the demand for loans surges as many individuals purchase items and undertake home renovations. Conversely, in the insurance category, the festive season doesn't result in significant changes. Instead, the insurance industry experiences its peak season after the festive period, particularly during the fourth quarter of the financial year.

“As the festive season approaches, there is a noticeable increase in car sales though, leading to a surge in the demand for motor insurance. Consequently, we see a significant uptick in the requests for motor insurance policies. During the festive period, there is an upswing in demand for various categories, such as electronics. However, in the insurance sector, this period doesn't significantly affect us, so we don't run specific campaigns targeting festivals. Nevertheless, we do roll out multiple campaigns throughout the year, and some of them may coincide with the festive season,” said Sethi.

According to the TAM AdEx report on BFSI sector across media for H1, the advertising volume of the sector grew on TV, radio and digital, but declined in the print medium. The report indicated that ad impressions on digital saw 91% rise during Jan-Jun '23 over Jan-Jun’22. The increase was 32% for radio and 4% for TV. The ad space of the BFSI sector decreased by 7% in print.

Speaking on media mix, Singh shared that BOB Financial has a good mix of customer segments belonging to Tier I, II and III. So, understanding their needs and preferred form of media channels, the company will reach out to them through relevant media promotions. “For the easy discovery of our offers, we shall have a dedicated offers page with regular promotion of top offers on our social media and other digital channels,” said Singh. Without disclosing the figure, Singh shared that the company’s promotion budget has surely increased from last year and it will be visible through their multi-channel promotional activities.

According to the TAM report, in the BFSI sector, life insurance is the leading category on TV and radio whereas mutual funds is the top category on digital.

Khare highlighted that in recent times, Bajaj Capital has observed a significant growth in audiences on online platforms and the changing preferences of their clientele. “This observation led us to recalibrate our marketing approach, placing a heightened emphasis on digital avenues,” said Khare.

He further added, “Our promotional efforts are primarily digital-focused, accentuating areas like social media engagement, search engine outreach, content-driven marketing, and targeted online advertising. As we approach the festive season, we've fine-tuned our online approach. By harnessing the insights from data analytics, we aim to grasp our clients' needs and inclinations better, ensuring our content is both tailored and pertinent.”

Khare also mentioned that Baja Capital has doubled its advertising budget compared to the previous year.

“This increase in our ad spend signifies our confidence in the opportunities this festive season presents. This impressive surge in our budget allocation underscores our dedication to maximizing the potential of this festive season and driving significant expansion within our business. We firmly believe that this increased investment in advertising will not only elevate our brand presence but also lead to an exceptional uptick in customer engagement and sales.”

For Policybazaar.com, the media strategy primarily involves a blend of television and digital platforms, an approach that has remained consistent in recent years and is expected to continue in the foreseeable future.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

OMD appoints Dileep Raj Singh as Head of Digital for APAC

Singh will report to Charlotte Lee, CEO of OMD APAC

OMD has added a Head of Digital (HOD) to its Asia Pacific (APAC) regional leadership team with the hiring of Dileep Raj Singh.

Singh is a digital native and brings with him a wealth of experience across product, media agency and client side in APAC, North America and the United Kingdom. His last 10 years have been spent building diverse digital marketing teams covering areas like performance marketing, digital media planning, ad/martech, product marketing, branding and measurement.

As HOD, he will accelerate OMD’s digital leadership agenda, rooted in helping clients address their business challenges and digital ambitions. He will be supporting OMD’s local teams in APAC on operational excellence, and digital transformation frameworks and roadmaps; and the development and implementation of our digital leadership agenda. He will also be working hand in hand with both our regional and global networks to initiate complementary workstreams for our clients in APAC.

“We will continue to invest and win in digital as part of our wider goal to be our clients’ most trusted business transformation partner,” said Charlotte Lee, CEO of OMD APAC.

“It is our global ambition to continue our leadership position in digital, data and technology. In line with this ambition, we are excited to have Singh come on board the OMD APAC leadership team. His background of agency, in-house and start-up experience position him perfectly to understand and address our clients’ business needs,” added Lee.

“Digital media and access to our audience, as we know it, is changing quite rapidly around us. This puts most of us in a delicate but remarkable position, a position from which we can shape and contribute to conversations about the next evolution of digital media. As we embark on this journey, I want to leverage the strength of the OMD network – people, technology, data, tools and platforms – to help our clients pivot and navigate through all the new and evolved possibilities in digital media. With this, I aim to position OMD as an unrivaled partner for our current and future clients; to dominate and succeed in this incredibly competitive and multifarious digital realm,” said Singh.

Singh will report to Lee, and work closely with the team including Chief Strategy Officer (CSO), David McCallen, and Chief Client Officer (CCO), Sadhan Mishra, to drive and support APAC local markets as well as regional clients on digital, data and technology needs.

Mishra was promoted to CCO of OMD APAC recently in June 2023. He will continue to be CEO of OMD Singapore, a position he was promoted into last August. Mishra has been with OMD for over 13 years and in his concurrent new role as CCO, he will focus on key client relationships, understanding their business needs and ensuring we remain a critical partner on their transformation journeys.

McCallen was elevated to the role of CSO of OMD APAC in April 2022, and was previously the CSO of OMD New Zealand for five years where he helped the agency to attain the top place in the market for new business, overall billings and award wins. Since starting in the APAC role, his focus has been on connecting and elevating strategic best practices across the region, building capabilities across a range of strategic outputs, and supporting new business growth both regionally and locally.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

test6

test

test

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Chandrayaan 3: Brands over the Moon

Some of the best moment marketing posts on India's crucial lunar mission

The nation is in a celebratory mood with its moon mission Chandrayaan 3 making its smooth landing on the lunar surface on the evening of August 23, 2023. The Pragyan rover is in pursuit of discovering water on the moon and is a vital feat for India's ambitious space research.

To celebrate this momentous episode in Indian space research history, netizens have taken to the internet to express their excitement, hopes and fears for the nation's lunar mission. Joining them are brands who have crafted creatives to mark the historic occasion and capture the emotions of the nation who have their eyes set on the moon. Here is our pick of some of the best Chandrayaan 3-moment marketing posts.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

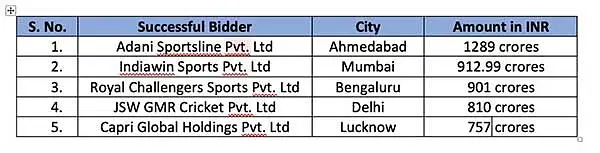

BCCI rakes in Rs 4670 cr in Women's Premier League team auction: Jay Shah 26 Jan

WPL has broken the inaugural auction record of Men's IPL in 2008, tweeted Shah

As expected, Wednesday turned out to be another historic day in Indian women's cricket with BCCI having a windfall gain of Rs 4,600 crores by auctioning five team franchises for the first season, a higher sum compared to what men’s IPL franchises offered to the cricket body during the launch in 2008.

Adani, IndiaWin Sports, Royal Challengers, GSW- GMR cricket and Capri Global have won the bid, BCCI secretary Jay Shah tweeted.

Shah shared in a series of tweets, “Today is a historic day in cricket as the bidding for teams of inaugural #WPL broke the records of the inaugural Men's IPL in 2008! Congratulations to the winners as we garnered Rs.4669.99 Cr in total bid.”

“This marks the beginning of a revolution in women's cricket and paves the way for a transformative journey ahead not only for our women cricketers but for the entire sports fraternity. The #WPL would bring necessary reforms in women's cricket and would ensure an all-encompassing ecosystem that benefits each and every stakeholder.”

“The @BCCI has named the league - Women's Premier League (WPL). Let the journey begin…”

The country's top corporates had bid aggressively for the league. Over 16 groups including IPL franchise owners, Adani group, Torrent and Haldiram were believed to be in the fray.

Given the popularity of IPL in India, the event is touted to be a big draw for all stakeholders involved.

The BCCI was reportedly expecting ₹4,000 crore gain through team auction.

It’s noteworthy that Viacom18 has won the Women's IPL media rights for Rs 951 crore for the next five years creating euphoria around the league whose first season will be held in March.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Share

Share