One Third of customers of a brand tend to drop out in the following year: Kantar

Josep Monserrat,CEO, Kantar Worldpanel and K. Ramakrishnan, Country Head, Kantar Wold Panel, India, share their thoughts on the FMCG sector and the major trends being seen in consumer behaviour and decision making.

As consumer behaviour keeps changing, the FMCG sector needs to be constantly be on its toes. Josep Monserrat, CEO, Kantar Worldpanel and K. Ramakrishnan, Country Head, IMRB Kantar Worldpanel, India, share their thoughts on the FMCG sector and the major trends being seen in consumer behaviour and decision making. Monserrat and Ramakrishnan touch upon different topics like the need for brands to cultivate new customers, the Patanjali phenomenon, among other things.

Excerpts:

Global brands are moving beyond their comfort zone and exploring new opportunities. How big is this trend and are we seeing this in India too?

Josep Monserrat: It is one of the drivers for tools that manufacturers are using. One is overcoming new barriers and, also, as soon as they get someone who starts using the product for a particular occasion, they try to expand to other occasions by using some communication or activity. This might expand the frequency of buying the brand and this is becoming something that brands are increasingly doing.

Your report mentions that 50 per cent of new buyers in FMCG sector won’t buy the same brand’s products next year? What is the reason for this and what can brands do about it?

Josep Monserrat: One of the reasons is that if you see the buyers that brands have in a year, most of them will buy your brand maybe once or twice a year. This means that you have plenty of infrequent buyers which you might lose next year. Manufacturers need to do one or two things. Firstly, to ensure there is enough churn they need recruit new buyers. This is because they know that they will lose some of them so they need to ensure that they can replace them. The other thing is to retain the buyers that they have by ensuring that they use their product on many different occasions, their products are available in stores; it is top of mind, it is at the right price and has the right packaging.

So what is easier---recruiting new buyers or retaining old buyers?

Josep Monserrat: It is difficult to say which is easier. What we are saying is that the marketers need to shape their mindset because they believe that the buyers they have drive growth and turn them into heavy users. The facts demonstrate that the best way of growing is to increase the users of your brand. What we are saying is you should not only focus on increasing loyalty of existing buyers, but be sure that you extend your penetration. It is difficult but we have provided drivers of growth in terms of driving penetration in the study.

K. Ramakrishnan: I think it is also about whether it is easier to do or important to do. What we are saying is that brands need to build new buyers because this has been demonstrated to lead to growth. We don’t know which of the two is easier but we feel that getting new buyers is important for a brand.

We have seen FMCG products being sold on e-commerce sites. Do you see this is a long-term and sustainable trend?

K. Ramakrishnan: Slightly difficult question to answer. You can look at the global trend and see whether that comes here or you can perceive what the situation in India is and how things will change. Typically, looking at the logistical and distribution challenges in India, e-commerce could be a way that provides some amount of growth but I would not hazard what that growth would be.

Josep Monserrat: Globally, we have seen that the pace of growth of FMCG on e-commerce has really accelerated.

Patanjali has flipped the market on its head. What is the long term impact of the brand that you see on the Indian FMCG sector?

K. Ramakrishan: There used to be brands, brands started associating with a cause and the cause became the reason why brands were bought. Here, it is the other way around. There is a cause and the cause has actually launched the brand. So, this is a new trend. You must have seen that after Patanjali, there have been so many brands that have launched similar products in the market.

What it does to the market in the long term is that since the number of categories where Patanjali has products is so large, it is creating a disturbance across the board. The typical household that buys Patanjali products will start from toothpaste and then go to other products. But do they continue to buy Patanjali products? This depends on the satisfaction they are able to get. Because of the fact that they are present in so many categories, the number of household that Patanjali is able to reach is really large and this is a little bit of an issue for players in the FMCG space.

What is the single most surprising or significant trend in terms of consumer behaviour that you have seen in the FMCG sector over the past few years?

Josep Monserrat: I think probably ‘premiumization.’ I think we have even seen in Western Europe where people go for discounts or private labels to save money. At the same time, they go to low price categories to save money, they also go to premium categories and are quite indulgent. That extreme of saving money on one hand and then buying premium brands is something we were surprised seeing because Western Europe was in recession at that point.

K. Ramakrishan: To add to the point of premiumization, even In India, we would expect sachets to only come for low-priced products but we have been seeing even products come out with low-price sachets in the Indian market. The need to indulge or try a premium product is present across social classes and to cater to this need, manufacturers are creating these products.

Going forward, what are the major trends that you foresee in the FMCG space?

Josep Monserrat: I think what we will see is an acceleration of some of the trends that we have already identified like premiumization, what is related to indulgence, etc. What will happen is that trends that are present will remain and some will be accelerated.

K. Ramakrishan: We see that new categories like herbal and natural making a comeback, not just Patanjali but beyond, will be big. The second is the development of hyperlocal brands in the country since India is multiple countries within one large country. These are trends that we are seeing will be big in the coming years.

What is Kantar Worldpanel’s roadmap when it comes to cross media measurement?

Josep Monserrat: The first thing is what we have announced that is the Consumer Mix Modelling, which is a new way of measuring RoI, which is based on connecting in a single flow, offline audience measurement and we will also be on digital. The second element is implementing our partnership with Facebook worldwide. Then, we are looking at how we can expand into digital from a mobile perspective since it is now very relevant.

Can you tell us something about your partnership with Facebook?

Josep Monserrat: It is a worldwide partnership where we are able to identify when users are exposed to any advertising in a Facebook environment. By doing this in partnership with Facebook in a completely secure and private manner, we will be able to provide brands the impact of their campaigns through Facebook, in terms of sales, penetration, etc. so you have a clear RoI. Brands will be able to benchmark clearly their spends and this will help them decide their spends.

How will new concepts like digital assistants, IoT, augmented reality, etc. change consumer purchase behaviour and decision making?

Josep Monserrat: I think that it already has some impact. The way brands are communicating to their clients or consumers has changed. Earlier it used to be unidirectional, now because of social networks, it is more two-way. Manufacturers are also learning from that and taking heed of the consumers which shapes their communications and helps them to innovate.

In your opinion, how can the FMCG sector continue its growth?

K. Ramakrishan: In our view, one of the things we keep saying is that one of the primary ways that Indian FMCG companies can grow is through penetration. By penetration, we mean what percentage of total households is the brand reaching. One way is to ensure the customer keeps coming back and the other is to reach out to new customers. We believe, and this has been proved by past data, that brands tend to grow by having new customers. This is because customers are not sticking to one brand, they tend to try multiple brands. At least one third of customers of a brand tend to drop out in the following year. In this scenario the only way for brands to grow is by getting new consumers.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Social Beat wins SEO mandate of Tata CLiQ tag rss

The account was won after a multi-agency pitch

e4m e4m Social Beat has won the SEO mandate for Tata CLiQ, one of the fastest-growing omnichannel marketplace in India. Social Beat has been entrusted with optimizing existing content, as well as launching new, optimized category pages systematically on Tata CLiQ’s platform to scale monthly organic traffic by 2x over the next year. The account was won after a multi-agency pitch and will be serviced by Social Beat’s offices in Mumbai.

Shishir Kataria, Director - Marketing, Tata CLiQ, “Shoppers, e-commerce or otherwise, continue to heavily rely on search and discovery throughout their shopping journey, be it engaging with the latest fashion trends or hunting for the best buys. No wonder a platform's ability to be a part of this journey organically drives significant consideration for it amongst potential shoppers. We, at Tata Cliq, are confident that Social Beat will help us develop and optimise content that is highly discoverable to grow our engagement and revenue. Our goal continues to be to drive more and more shoppers to our platform with optimised and curated products and relevant content.”

Vikas Chawla, Co-Founder, Social Beat said, “We are thrilled to partner with Tata CLiQ in their growth journey. We aim to scale traffic to the Tata CLiQ platform manyfold over the next year. Our team of specialised SEO and Content strategists will be working closely to achieve this”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Will OOH dazzle this festive season?

As the celebrations begin, experts tell us the trends and challenges for the OOH sector this season

Be it the flower-clad taxis in Mumbai for Made in Heaven Season 2 promotion or Zomato’s ‘kheer mangoge kheer denge’ billboards, India's OOH advertising sector has undergone substantial transformation and expansion in the recent years. Even though the medium was severely hit during the pandemic years, it has now managed to rebuild its status. Now, with the onset of the festive season, elections and the cricket world cup, OOH is expected to see more and more advertisers come on board.

Amarjeet Hudda, Chief Operating Officer, Laqshya Media Group, believes most of the clients spend a lot of money during the festive season, especially for Durga Puja, Dussehra and Diwali, targeting their customers in a festive mood. The categories that spend heavily during these months are Auto, Consumer Durables, Real Estate, Organised retail, and E-commerce.

According to Dipankar Sanyal of Platinum Outdoor, there was a huge surge in the festive season last year, and he expects the same this year too. “Last four to five years have turbulent for outdoor. It was picking up in 2019, but then Covid came and everything went flat for two years,” he mentioned.

According to EY-FICCI’s M&E Report 2023, OOH media grew 86 percent in 2022 to Rs 37 billion. The value includes traditional, transit and digital media, but excludes untracked unorganised OOH media such as wall paintings, billboards, ambient media, storefronts, proxy advertising.

Sharing the brand’s perspective, Shivam Ranjan, Head of Marketing, Motorola-APAC, said, “We are going into this festive season with a strong mix of media, including OOH. Within OOH, we are focusing on digital OOH, due to its capability of programmatic serving, measurability, and near real-time insights that allow us to be agile with the communication and optimisation of our campaigns.”

With urbanisation, improved infrastructure, rising consumerism and an increased spending power, clients' expectations from OOH advertising too have evolved. “The clients expect better ROI on every investment, best in class innovations, tech-led planning and execution. Today, technology plays an important role starting from planning the campaign, to measuring metrics to ROI,” Singh explained.

Another trend that Sanyal has observed is that traditionally advertisers looked at spending on OOH nearly two weeks prior to the festivities, but now, most advertisers have now started advertising a week earlier so that they can get maximum eyeballs. Additionally, the digital OOH advertising (DOOH) has also emerged big. The digital OOH screens increased to around 100,000 and contributed eight percent of total segment revenues.

“Now with digital, there is more space for advertisers to come in one frame. Because of this, you can see it is getting more attractive. The innovations too are coming in at a much lower cost and creating a greater impact,” shared Sanyal.

The only challenge with the medium, according to Ranjan, is OOH being a fragmented industry with lack of measurability and agility. This becomes a serious issue for ROI-centric brands. However, the growth of DOOH, which is dynamic, agile and measurable, is giving marketers the confidence to invest in the medium backed by relevant data and outcomes.

Adding to this, Hudda highlighted that availability of good media spots is the biggest challenge in this season as media assets are limited and demand is very high. Due to the gap in the festive season, many clients are not able to fully optimise their campaigns. Rather sometimes, clients are even compelled to divert their budget which adversely impacts the industry, he shared.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Banking on positive consumer sentiment: BFSI optimistic on doubling festive AdEx : Cache

Some categories within the sector, however, may spend more in the quarter that follows the festive season

The BFSI sector is expecting a surge in demand for loan during the festive season and is looking at increasing its ad spends to cash in on the celebration spirit. Industry leaders say they are hopeful of witnessing a good growth in the number of applications for auto loan, home loan, credit card and health insurance during October, November and December due to positive consumer sentiment this year. However, though most of the BFSI players are planning to double their advertising budget this time compared to the previous year, there are some who are not investing too heavily on marketing during the festivals as they plan to save the money for the fourth quarter.

According to Shailendra Singh, MD & CEO, BOB Financial, they witness incremental growth every year during the October-December quarter, and they anticipate an increase in consumer spending as well as new enrolments for cards this year too. “There remains a surge in customer demand for credit during the festive season,” said Singh.

Singh shared that the company is fully geared up for the launch of #FestiveShoppingRewards on all Bank of Baroda credit card variants under the theme ‘Reimagine Festivities’. They would kickstart festive offerings with the start of Navratri.

The festive season does not just see the demand for credit go up, but there is an increase in applications for health and motor insurance too during this time of the year.

Aabhinna Suresh Khare, Chief Digital & Marketing Officer, BajajCapital Ltd, shared that among insurance products, health insurance and motor insurance reign supreme during festivals. According to Khare, the demand for mutual funds and SIPs too sees a hike.

“Overall, the festive season presents an opportune moment to secure insurance coverage. A plethora of attractive products and services are on offer, with financial institutions extending special discounts and promotions to entice new customers,” said Khare.

The company launched #BlessMeGanesha campaign during Ganesh Chaturthi. “Our goal for this festive season is not only to provide financial solutions but also to create memorable experiences and deepen the connection with our customers,” said Khare.

Though all major sectors spend heavily on advertising during the festive season, within the BFSI sector, some categories spend more in the quarter that follows the festive season.

Explaining the trend, Samir Sethi, Head of Brand Marketing, Policybazaar.com, said that the festive season has varying impacts on the BFSI sector. In the banking sector, for instance, the demand for loans surges as many individuals purchase items and undertake home renovations. Conversely, in the insurance category, the festive season doesn't result in significant changes. Instead, the insurance industry experiences its peak season after the festive period, particularly during the fourth quarter of the financial year.

“As the festive season approaches, there is a noticeable increase in car sales though, leading to a surge in the demand for motor insurance. Consequently, we see a significant uptick in the requests for motor insurance policies. During the festive period, there is an upswing in demand for various categories, such as electronics. However, in the insurance sector, this period doesn't significantly affect us, so we don't run specific campaigns targeting festivals. Nevertheless, we do roll out multiple campaigns throughout the year, and some of them may coincide with the festive season,” said Sethi.

According to the TAM AdEx report on BFSI sector across media for H1, the advertising volume of the sector grew on TV, radio and digital, but declined in the print medium. The report indicated that ad impressions on digital saw 91% rise during Jan-Jun '23 over Jan-Jun’22. The increase was 32% for radio and 4% for TV. The ad space of the BFSI sector decreased by 7% in print.

Speaking on media mix, Singh shared that BOB Financial has a good mix of customer segments belonging to Tier I, II and III. So, understanding their needs and preferred form of media channels, the company will reach out to them through relevant media promotions. “For the easy discovery of our offers, we shall have a dedicated offers page with regular promotion of top offers on our social media and other digital channels,” said Singh. Without disclosing the figure, Singh shared that the company’s promotion budget has surely increased from last year and it will be visible through their multi-channel promotional activities.

According to the TAM report, in the BFSI sector, life insurance is the leading category on TV and radio whereas mutual funds is the top category on digital.

Khare highlighted that in recent times, Bajaj Capital has observed a significant growth in audiences on online platforms and the changing preferences of their clientele. “This observation led us to recalibrate our marketing approach, placing a heightened emphasis on digital avenues,” said Khare.

He further added, “Our promotional efforts are primarily digital-focused, accentuating areas like social media engagement, search engine outreach, content-driven marketing, and targeted online advertising. As we approach the festive season, we've fine-tuned our online approach. By harnessing the insights from data analytics, we aim to grasp our clients' needs and inclinations better, ensuring our content is both tailored and pertinent.”

Khare also mentioned that Baja Capital has doubled its advertising budget compared to the previous year.

“This increase in our ad spend signifies our confidence in the opportunities this festive season presents. This impressive surge in our budget allocation underscores our dedication to maximizing the potential of this festive season and driving significant expansion within our business. We firmly believe that this increased investment in advertising will not only elevate our brand presence but also lead to an exceptional uptick in customer engagement and sales.”

For Policybazaar.com, the media strategy primarily involves a blend of television and digital platforms, an approach that has remained consistent in recent years and is expected to continue in the foreseeable future.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

OMD appoints Dileep Raj Singh as Head of Digital for APAC

Singh will report to Charlotte Lee, CEO of OMD APAC

OMD has added a Head of Digital (HOD) to its Asia Pacific (APAC) regional leadership team with the hiring of Dileep Raj Singh.

Singh is a digital native and brings with him a wealth of experience across product, media agency and client side in APAC, North America and the United Kingdom. His last 10 years have been spent building diverse digital marketing teams covering areas like performance marketing, digital media planning, ad/martech, product marketing, branding and measurement.

As HOD, he will accelerate OMD’s digital leadership agenda, rooted in helping clients address their business challenges and digital ambitions. He will be supporting OMD’s local teams in APAC on operational excellence, and digital transformation frameworks and roadmaps; and the development and implementation of our digital leadership agenda. He will also be working hand in hand with both our regional and global networks to initiate complementary workstreams for our clients in APAC.

“We will continue to invest and win in digital as part of our wider goal to be our clients’ most trusted business transformation partner,” said Charlotte Lee, CEO of OMD APAC.

“It is our global ambition to continue our leadership position in digital, data and technology. In line with this ambition, we are excited to have Singh come on board the OMD APAC leadership team. His background of agency, in-house and start-up experience position him perfectly to understand and address our clients’ business needs,” added Lee.

“Digital media and access to our audience, as we know it, is changing quite rapidly around us. This puts most of us in a delicate but remarkable position, a position from which we can shape and contribute to conversations about the next evolution of digital media. As we embark on this journey, I want to leverage the strength of the OMD network – people, technology, data, tools and platforms – to help our clients pivot and navigate through all the new and evolved possibilities in digital media. With this, I aim to position OMD as an unrivaled partner for our current and future clients; to dominate and succeed in this incredibly competitive and multifarious digital realm,” said Singh.

Singh will report to Lee, and work closely with the team including Chief Strategy Officer (CSO), David McCallen, and Chief Client Officer (CCO), Sadhan Mishra, to drive and support APAC local markets as well as regional clients on digital, data and technology needs.

Mishra was promoted to CCO of OMD APAC recently in June 2023. He will continue to be CEO of OMD Singapore, a position he was promoted into last August. Mishra has been with OMD for over 13 years and in his concurrent new role as CCO, he will focus on key client relationships, understanding their business needs and ensuring we remain a critical partner on their transformation journeys.

McCallen was elevated to the role of CSO of OMD APAC in April 2022, and was previously the CSO of OMD New Zealand for five years where he helped the agency to attain the top place in the market for new business, overall billings and award wins. Since starting in the APAC role, his focus has been on connecting and elevating strategic best practices across the region, building capabilities across a range of strategic outputs, and supporting new business growth both regionally and locally.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

test6

test

test

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Chandrayaan 3: Brands over the Moon

Some of the best moment marketing posts on India's crucial lunar mission

The nation is in a celebratory mood with its moon mission Chandrayaan 3 making its smooth landing on the lunar surface on the evening of August 23, 2023. The Pragyan rover is in pursuit of discovering water on the moon and is a vital feat for India's ambitious space research.

To celebrate this momentous episode in Indian space research history, netizens have taken to the internet to express their excitement, hopes and fears for the nation's lunar mission. Joining them are brands who have crafted creatives to mark the historic occasion and capture the emotions of the nation who have their eyes set on the moon. Here is our pick of some of the best Chandrayaan 3-moment marketing posts.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

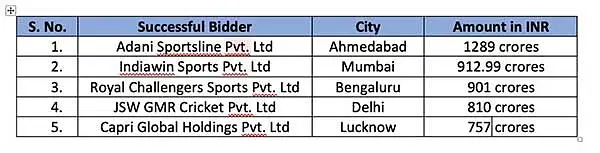

BCCI rakes in Rs 4670 cr in Women's Premier League team auction: Jay Shah 26 Jan

WPL has broken the inaugural auction record of Men's IPL in 2008, tweeted Shah

As expected, Wednesday turned out to be another historic day in Indian women's cricket with BCCI having a windfall gain of Rs 4,600 crores by auctioning five team franchises for the first season, a higher sum compared to what men’s IPL franchises offered to the cricket body during the launch in 2008.

Adani, IndiaWin Sports, Royal Challengers, GSW- GMR cricket and Capri Global have won the bid, BCCI secretary Jay Shah tweeted.

Shah shared in a series of tweets, “Today is a historic day in cricket as the bidding for teams of inaugural #WPL broke the records of the inaugural Men's IPL in 2008! Congratulations to the winners as we garnered Rs.4669.99 Cr in total bid.”

“This marks the beginning of a revolution in women's cricket and paves the way for a transformative journey ahead not only for our women cricketers but for the entire sports fraternity. The #WPL would bring necessary reforms in women's cricket and would ensure an all-encompassing ecosystem that benefits each and every stakeholder.”

“The @BCCI has named the league - Women's Premier League (WPL). Let the journey begin…”

The country's top corporates had bid aggressively for the league. Over 16 groups including IPL franchise owners, Adani group, Torrent and Haldiram were believed to be in the fray.

Given the popularity of IPL in India, the event is touted to be a big draw for all stakeholders involved.

The BCCI was reportedly expecting ₹4,000 crore gain through team auction.

It’s noteworthy that Viacom18 has won the Women's IPL media rights for Rs 951 crore for the next five years creating euphoria around the league whose first season will be held in March.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Share

Share