How India Inc can leverage brands

Peter Drucker, wrote, "Business has two basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs." This comment has never been truer than it is today. In developing economies such as India, the supply of goods and services is increasing exponentially. This puts a premium on a brand's ability to communicate its unique ability to satisfy customer needs.

Peter Drucker, the renowned business author, wrote, "Business has two basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs."

In his habitually prescient way (he made this comment in 1954), Peter Drucker identified that the creation of customer value — through invention or through brands — is the only sustainable foundation for business.

This comment has never been truer than it is today. In developing economies such as India, the supply of goods and services is increasing exponentially. This puts a premium on a brand's ability to communicate its unique ability to satisfy customer needs.

This abundance of choice can be confusing for consumers, especially as the perceived differences between the products and services have narrowed. Paul Goldberger, the cultural correspondent of the The New York Times, neatly encapsulated this phenomenon when he remarked that "while everything may be better, it is also increasingly the same."

More goods, all of higher quality, chasing limited customer rupees creates an environment in which the sources of value creation have moved increasingly from tangible assets (such as plant and machinery) to intangible ones (such as brands, patents, customer databases and skilled workforce). This is an environment in which the scarce resources are not factories and goods, but rather talented people, good ideas and differentiated brands.

Reflecting this shift in the sources of value creation, the market-to tangible-asset ratio for the S&P 500 (the broad-based index of the 500 largest companies in the US) has risen from 1.3 in the early '80s to 4.6 as of July 2004.

This means that the tangible assets recorded on the balance sheets of these 500 companies that used to account for over 75 per cent of their stock market value in the early '80s now explain less than 22 per cent of the market value of these companies.

Investors recognise that the productive resources of these companies are increasingly represented by assets that do not appear in the financial statements - patents, supply chain systems, distribution rights, skilled workers and brands. Within the S&P 500, there is only one industry sector - utilities - in which tangible assets represent more than 50 per cent of market value.

The migration of value to intangible assets is quite dramatic in India. The analysis of the top 500 companies listed on the Bombay Stock Exchange index shows that intangible assets represented around 43 per cent of the value that investors were placing on these businesses.

The charts alongside are quite revealing: A review of the top 500 largest listed companies in India by market value suggests that only 55 per cent of market value is explained by tangible assets and 2 per cent by disclosed intangibles. What makes up the 43 per cent of unexplained value?

It also poses the question: What makes up unexplained value? To appreciate these issues from a wider context we have also compared the top 500 listed Indian companies with those in the other countries in the US, Spain, Australia, Canada, India and Singapore.

The third chart shows asset split by a sample of economies. Given the growing importance of brands and other intangibles it is odd that an analysis of balance sheets of large Indian companies indicates that capitalised intangible assets (disclosed intangibles) represent less than 2 per cent of their market value.

The results show that Indian companies have a lower proportion of intangible assets recognised or otherwise when compared to other leading economies except Singapore. However, it must be noted that in technology, financial and consumer sectors, the intangible value of Indian firms is high (close to 70 per cent). Even so, Indian companies have some way to go to meet with economies like the US, Spain and Australia, which are largely driven by the value of intangibles. This is partly a reflection of Indian managements' failure to recognise and invest in intangibles and brand assets. By the same measure it is also a reflection of the investment community's failure to recognise and invest in a company's intangible assets.

The importance of understanding the intangible assets that now account for an increasingly large proportion of business value has been reinforced by recent changes in the accounting standards for business acquisitions.

The work of the International Accounting Standards Board resulted in a new reporting standard for "business combinations." International Financial Reporting Standard 3 (IFRS 3), which came into force at the end of March 2004, provides for a single international accounting treatment for acquisitions. Adopting the precedent set by the US Financial Accounting Standard 141 (FAS 141) of June 2001, IFRS 3 requires that "goodwill" be specifically allocated to the intangible assets acquired.

The goal of FAS 141 and IFRS 3 is to require companies to be transparent about the nature and scale of the assets that they are acquiring. It is no longer permissible to report a single "goodwill" figure representing the excess of the purchase price over the tangible assets acquired. Goodwill must be allocated to five classes of intangible assets - technology-based assets (such as patents), contract-based assets (such as leases and licensing agreements), artistic assets (such as plays and films), customer-based assets (such as customer lists) and marketing-related assets (such as trademarks and brands).

The combination of the increasing economic significance of brands and this reform to accounting standards has heightened the importance of a well-informed discussion of the value that brands add to the bottomline.

The goal of this report is to contribute to this discussion by providing an overview of the methodologies for measuring brand equity from the customer perspective, and for measuring how this customer equity translates into superior business value.

To provide momentum to this discussion, Brand Finance has created a comprehensive analysis of India's top value creating brands. To our knowledge, this is the first time that such a list has been produced for Indian companies.

Further, Brand Finance has also rated these brands on their brand power. This is because a brand value reflects not only the potential of a brand to generate income, but also the likelihood that the brand will do so. It is therefore necessary to determine an appropriate discount rate which takes into account market and brand risks.

The Brand Finance Rating panel has developed an approach to discount rate determination grounded in investment theory. This approach was designed to be transparent, objective and reproducible. The analysis considers a number of objectively verifiable key indicators of brand performance. All brands in the market are scored relative to one another to arrive at the relevant rating for the brand being valued.

Having scored all brands against the objectively verifiable criteria, Brand Ratings are determined. These are effectively credit ratings for brands and just as traditional credit rating drives the rates at which banks will lend to corporations the Brand Power Ratings determine the required rate of return implicit in the brand valuation.

The Brand Leverage analysis measures the extent to which the company has used the brand to drive value for the business. In today's business environment where intangibles increasingly drive business value, the brand's value should be comparable or ideally more than the company's book value.

In what appears to be the age of branding, it is surprising to hear of managers' difficulties in securing funds for investments in their brands. A lingering, unanswered question seems partly to blame; do brand-building investments really pay off? Lacking conclusive evidence concerning brands as economic assets that affect the bottomline, brand `investments' remain little more than discretionary `expenses' that are cut at the drop of a hat.

One reason for this paradox is that marketers have struggled to define a credible way of measuring the long-term value that marketing adds to a business. Measurement of the return on marketing investment has typically focused on the short-term uplift on sales as a result of a new campaign, rather than on the creation of a business asset.

The challenge to the marketing profession is to demonstrate that brands are business assets capable of generating superior economic returns for their owners, and worthy of multi-year investment commitments.

To do so, marketers need to show that they have a robust approach for measuring the quality of their brand assets, and for quantifying the contribution that the brand asset makes to shareholder value.

This study aims to provide Indian companies with a board-savvy argument for the value of brands. In essence the problem of convincing the board of the value inherent in brands involves conceptualising marketing as an investment to create a brand asset rather than an expense.

For the first time Indian chief executives can talk to shareholders, investors and employees about the health and long-term outlook of their brands in an objective, factual manner.

A perusal of the three tables on Page 3 — Brand Value, Brand Power Index and Brand leverage ratio — shows that even though IOC is India's top value creating brand, the brand's power index is relatively quite low, only getting a BB+ rating. Hence, IOC is at a higher risk of losing the brand revenues it currently enjoys to more powerful brands such as Bharat Petroleum (BBB-) in future. With brands such as Reliance (BBB-), Shell, and Essar moving into the fray, IOC needs to strengthen its brand power urgently. Further, IOC's Brand Leverage Ratio (Brand Value: Book Value) is only 0.7. This shows that the brand's value has some way to go to match IOC's tangible assets.

i-flex's brand value is lower in comparison to IOC today. However, i-flex muscles its way to the top of the Brand Power Index ratings. It is India's most powerful brand in terms of its ability to sustain earnings into the future with the least risk. Its ability to create a world-class product brand like Flexcube demonstrates it brand power. Further, with a Brand Leverage of only 0.8 (compared to TCS's 3.9) the brand has significant potential for adding business value. If i-flex continues to strengthen its brand power and extends successfully into services where it can extract volume and premium to a greater extent, its rise in the value table will not be surprising.

Among banks, SBI emerges as the most valuable financial services brand at $1.9 billion. However, the brand's power index rating lags at BB+. In a scenario where the banking sector is moving towards consolidation and the emergence of stronger competition SBI will have to get its act together by engaging with consumers and developing products and services which are differentiated. The Brand Leverage Ratio is only 0.3. For a highly customer-driven business, this is quite low. Whether it is a private sector or a public sector, banks in general seem to face a similar problem. The debate in the financial services market is rapidly changing with technology implementation and operational efficiency becoming table stakes.

To break the current supply side parity, players will have to come up with market expansion strategies which are based on unique consumer insights. Brands such as SBI and ICICI occupy the third and tenth slot in value terms and need to realise that their brands have significant potential in creating value for the businesses.

Yet their power indices tend to drift towards the lower end of the table. This signifies a less than optimal ability to hold on to market share and revenues in the emerging competitive scenario. Clearly size is not the only factor that should drive banking mergers in the near future.

There are significant value issues that are at stake with the government favouring mergers in the oil and banking sector. Consider the proposed merger of BP and HP. While both companies are comparable in terms of business profile and their revenues, brand values are significantly different, with BP worth $625 million more than its twin.

Bharat Petroleum's relentless pursuit to engage with consumers through its pioneering and still evolving retailing initiative `Pure for Sure' and its aggressive foray into branded fuels under the Speed brand have yielded significant benefits. Thus from strategic and economic standpoints, these results clearly give a direction on which brands to retain and which to phase out in case of a mega merger. Similar issues are also evident in case of mergers which are being considered among public sector banks.

Among the IT firms, TCS emerges as the most valuable as well as a highly resilient brand. Furthermore, TCS has the unique distinction of leveraging its brand to such an extent that its brand value is close to four times its book value.

Indeed, this is the benchmark for other Indian IT firms and brands across sectors. However, Infosys is within striking distance and with an identical brand power can prove to be stiff competition in future.

Ranbaxy is ahead of its peers like Cipla and Dr. Reddy's in terms of value as well as brand power. With their mainstay generics business getting increasingly crowded and margins under acute pressure, differentiated products under strong brands will be the strategy for the future. To establish a beachhead in their global markets, pharmaceutical companies will have to be on the look-out for under-leveraged brand assets which can be bought or licensed from their owners.

Bharti's Airtel is India's most valuable telecom brand, admittedly in the absence of other heavyweights such as Hutch, this year. While the brand has a high power rating it has scope for increasing it by focusing on revenue maximisation through adapting its pricing plans and aligning its entire organisation towards a unified brand delivery. Like Orange, the brand could also explore the opportunity to leverage its brand by licensing it to the fast growing markets such as China, Africa and West Asia.

In the bigger picture, the tables should serve as a wake-up call to corporate India to recognise brands as significant assets, which are driving business value. We see huge potential for Indian companies to add value to their businesses by isolating the economic value of their brands and appreciating the value drivers and the extent to which they are being leveraged.

The potential to fine-tune brand investments and directing precious resources to where it can earn maximum return is immense even among companies which have adopted a sound marketing philosophy.

Companies need to wake up to the fact that there is considerable scope to use brand assets in varied ways to drive revenues and margins in the future.

Conclusions

Many business heads — and a fair proportion of marketing professionals themselves — are frustrated about the lack of a framework for measuring and managing brand equity in a way that links directly the metrics that CEOs care about.

The goal of this report has been to suggest ways in which this gap can be narrowed. Specific suggestions include:

· Acknowledging that brand equity is an intermediary step towards the larger goal of creating a more successful business

· Accepting the need to express the impact of brands in terms of profitability, growth and risk

· Defining brand equity in a way that captures the potential of a brand to create future cash flow

Marketing Dashboards or Scorecards

One technique for expressing this "mental map" is the creation of a brand dashboard. The goal of a marketing dashboard is to express in a simple, easily grasped format the key indicators of marketing performance.

Techniques vary — at Brand Finance, we favour an approach that includes indicators of performance at four levels: marketing actions, customer attitudes, customer behaviours and market performance.

Marketing Return on Investment

ROMI or mROI is currently a hot topic and rightfully so. The increasing availability of tracking data across a range of media and the ability to cross-tab data from different sources has created a fertile environment for new measurement techniques and progress towards the goal of greater marketing accountability.

Centralised Ownership and Management of Intellectual Property

An increasing number of companies are adopting a more sophisticated approach to the management of their brands, patents and other forms of Intellectual Property (IP). This generally takes the form of the creation of a specific group holding company that assumes ownership of the Intellectual Property assets of the group and charges a royalty to the group operating companies for their use.This approach offers three main forms of benefit — enhancement of the management of these assets; the opportunity for tax planning; and behavioural change on the part of all those that are involved in the financing, development or use of the brand.

Reclaiming a seat at the table

The fact that the finance, accounting and legal departments are already embarked on this path increases the urgency for marketers to claim their place at the table.

Marketing has a unique perspective to offer. It is the only discipline that sees the business from the perspective of the customer and sees the brand in its full context — as the vehicle for customer meaning and not just some piece of intellectual property. The key thing for marketers is to engage in the debate, accepting that the language they will need to use is that of shareholder value.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Social Beat wins SEO mandate of Tata CLiQ tag rss

The account was won after a multi-agency pitch

e4m e4m Social Beat has won the SEO mandate for Tata CLiQ, one of the fastest-growing omnichannel marketplace in India. Social Beat has been entrusted with optimizing existing content, as well as launching new, optimized category pages systematically on Tata CLiQ’s platform to scale monthly organic traffic by 2x over the next year. The account was won after a multi-agency pitch and will be serviced by Social Beat’s offices in Mumbai.

Shishir Kataria, Director - Marketing, Tata CLiQ, “Shoppers, e-commerce or otherwise, continue to heavily rely on search and discovery throughout their shopping journey, be it engaging with the latest fashion trends or hunting for the best buys. No wonder a platform's ability to be a part of this journey organically drives significant consideration for it amongst potential shoppers. We, at Tata Cliq, are confident that Social Beat will help us develop and optimise content that is highly discoverable to grow our engagement and revenue. Our goal continues to be to drive more and more shoppers to our platform with optimised and curated products and relevant content.”

Vikas Chawla, Co-Founder, Social Beat said, “We are thrilled to partner with Tata CLiQ in their growth journey. We aim to scale traffic to the Tata CLiQ platform manyfold over the next year. Our team of specialised SEO and Content strategists will be working closely to achieve this”

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Will OOH dazzle this festive season?

As the celebrations begin, experts tell us the trends and challenges for the OOH sector this season

Be it the flower-clad taxis in Mumbai for Made in Heaven Season 2 promotion or Zomato’s ‘kheer mangoge kheer denge’ billboards, India's OOH advertising sector has undergone substantial transformation and expansion in the recent years. Even though the medium was severely hit during the pandemic years, it has now managed to rebuild its status. Now, with the onset of the festive season, elections and the cricket world cup, OOH is expected to see more and more advertisers come on board.

Amarjeet Hudda, Chief Operating Officer, Laqshya Media Group, believes most of the clients spend a lot of money during the festive season, especially for Durga Puja, Dussehra and Diwali, targeting their customers in a festive mood. The categories that spend heavily during these months are Auto, Consumer Durables, Real Estate, Organised retail, and E-commerce.

According to Dipankar Sanyal of Platinum Outdoor, there was a huge surge in the festive season last year, and he expects the same this year too. “Last four to five years have turbulent for outdoor. It was picking up in 2019, but then Covid came and everything went flat for two years,” he mentioned.

According to EY-FICCI’s M&E Report 2023, OOH media grew 86 percent in 2022 to Rs 37 billion. The value includes traditional, transit and digital media, but excludes untracked unorganised OOH media such as wall paintings, billboards, ambient media, storefronts, proxy advertising.

Sharing the brand’s perspective, Shivam Ranjan, Head of Marketing, Motorola-APAC, said, “We are going into this festive season with a strong mix of media, including OOH. Within OOH, we are focusing on digital OOH, due to its capability of programmatic serving, measurability, and near real-time insights that allow us to be agile with the communication and optimisation of our campaigns.”

With urbanisation, improved infrastructure, rising consumerism and an increased spending power, clients' expectations from OOH advertising too have evolved. “The clients expect better ROI on every investment, best in class innovations, tech-led planning and execution. Today, technology plays an important role starting from planning the campaign, to measuring metrics to ROI,” Singh explained.

Another trend that Sanyal has observed is that traditionally advertisers looked at spending on OOH nearly two weeks prior to the festivities, but now, most advertisers have now started advertising a week earlier so that they can get maximum eyeballs. Additionally, the digital OOH advertising (DOOH) has also emerged big. The digital OOH screens increased to around 100,000 and contributed eight percent of total segment revenues.

“Now with digital, there is more space for advertisers to come in one frame. Because of this, you can see it is getting more attractive. The innovations too are coming in at a much lower cost and creating a greater impact,” shared Sanyal.

The only challenge with the medium, according to Ranjan, is OOH being a fragmented industry with lack of measurability and agility. This becomes a serious issue for ROI-centric brands. However, the growth of DOOH, which is dynamic, agile and measurable, is giving marketers the confidence to invest in the medium backed by relevant data and outcomes.

Adding to this, Hudda highlighted that availability of good media spots is the biggest challenge in this season as media assets are limited and demand is very high. Due to the gap in the festive season, many clients are not able to fully optimise their campaigns. Rather sometimes, clients are even compelled to divert their budget which adversely impacts the industry, he shared.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Banking on positive consumer sentiment: BFSI optimistic on doubling festive AdEx : Cache

Some categories within the sector, however, may spend more in the quarter that follows the festive season

The BFSI sector is expecting a surge in demand for loan during the festive season and is looking at increasing its ad spends to cash in on the celebration spirit. Industry leaders say they are hopeful of witnessing a good growth in the number of applications for auto loan, home loan, credit card and health insurance during October, November and December due to positive consumer sentiment this year. However, though most of the BFSI players are planning to double their advertising budget this time compared to the previous year, there are some who are not investing too heavily on marketing during the festivals as they plan to save the money for the fourth quarter.

According to Shailendra Singh, MD & CEO, BOB Financial, they witness incremental growth every year during the October-December quarter, and they anticipate an increase in consumer spending as well as new enrolments for cards this year too. “There remains a surge in customer demand for credit during the festive season,” said Singh.

Singh shared that the company is fully geared up for the launch of #FestiveShoppingRewards on all Bank of Baroda credit card variants under the theme ‘Reimagine Festivities’. They would kickstart festive offerings with the start of Navratri.

The festive season does not just see the demand for credit go up, but there is an increase in applications for health and motor insurance too during this time of the year.

Aabhinna Suresh Khare, Chief Digital & Marketing Officer, BajajCapital Ltd, shared that among insurance products, health insurance and motor insurance reign supreme during festivals. According to Khare, the demand for mutual funds and SIPs too sees a hike.

“Overall, the festive season presents an opportune moment to secure insurance coverage. A plethora of attractive products and services are on offer, with financial institutions extending special discounts and promotions to entice new customers,” said Khare.

The company launched #BlessMeGanesha campaign during Ganesh Chaturthi. “Our goal for this festive season is not only to provide financial solutions but also to create memorable experiences and deepen the connection with our customers,” said Khare.

Though all major sectors spend heavily on advertising during the festive season, within the BFSI sector, some categories spend more in the quarter that follows the festive season.

Explaining the trend, Samir Sethi, Head of Brand Marketing, Policybazaar.com, said that the festive season has varying impacts on the BFSI sector. In the banking sector, for instance, the demand for loans surges as many individuals purchase items and undertake home renovations. Conversely, in the insurance category, the festive season doesn't result in significant changes. Instead, the insurance industry experiences its peak season after the festive period, particularly during the fourth quarter of the financial year.

“As the festive season approaches, there is a noticeable increase in car sales though, leading to a surge in the demand for motor insurance. Consequently, we see a significant uptick in the requests for motor insurance policies. During the festive period, there is an upswing in demand for various categories, such as electronics. However, in the insurance sector, this period doesn't significantly affect us, so we don't run specific campaigns targeting festivals. Nevertheless, we do roll out multiple campaigns throughout the year, and some of them may coincide with the festive season,” said Sethi.

According to the TAM AdEx report on BFSI sector across media for H1, the advertising volume of the sector grew on TV, radio and digital, but declined in the print medium. The report indicated that ad impressions on digital saw 91% rise during Jan-Jun '23 over Jan-Jun’22. The increase was 32% for radio and 4% for TV. The ad space of the BFSI sector decreased by 7% in print.

Speaking on media mix, Singh shared that BOB Financial has a good mix of customer segments belonging to Tier I, II and III. So, understanding their needs and preferred form of media channels, the company will reach out to them through relevant media promotions. “For the easy discovery of our offers, we shall have a dedicated offers page with regular promotion of top offers on our social media and other digital channels,” said Singh. Without disclosing the figure, Singh shared that the company’s promotion budget has surely increased from last year and it will be visible through their multi-channel promotional activities.

According to the TAM report, in the BFSI sector, life insurance is the leading category on TV and radio whereas mutual funds is the top category on digital.

Khare highlighted that in recent times, Bajaj Capital has observed a significant growth in audiences on online platforms and the changing preferences of their clientele. “This observation led us to recalibrate our marketing approach, placing a heightened emphasis on digital avenues,” said Khare.

He further added, “Our promotional efforts are primarily digital-focused, accentuating areas like social media engagement, search engine outreach, content-driven marketing, and targeted online advertising. As we approach the festive season, we've fine-tuned our online approach. By harnessing the insights from data analytics, we aim to grasp our clients' needs and inclinations better, ensuring our content is both tailored and pertinent.”

Khare also mentioned that Baja Capital has doubled its advertising budget compared to the previous year.

“This increase in our ad spend signifies our confidence in the opportunities this festive season presents. This impressive surge in our budget allocation underscores our dedication to maximizing the potential of this festive season and driving significant expansion within our business. We firmly believe that this increased investment in advertising will not only elevate our brand presence but also lead to an exceptional uptick in customer engagement and sales.”

For Policybazaar.com, the media strategy primarily involves a blend of television and digital platforms, an approach that has remained consistent in recent years and is expected to continue in the foreseeable future.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

OMD appoints Dileep Raj Singh as Head of Digital for APAC

Singh will report to Charlotte Lee, CEO of OMD APAC

OMD has added a Head of Digital (HOD) to its Asia Pacific (APAC) regional leadership team with the hiring of Dileep Raj Singh.

Singh is a digital native and brings with him a wealth of experience across product, media agency and client side in APAC, North America and the United Kingdom. His last 10 years have been spent building diverse digital marketing teams covering areas like performance marketing, digital media planning, ad/martech, product marketing, branding and measurement.

As HOD, he will accelerate OMD’s digital leadership agenda, rooted in helping clients address their business challenges and digital ambitions. He will be supporting OMD’s local teams in APAC on operational excellence, and digital transformation frameworks and roadmaps; and the development and implementation of our digital leadership agenda. He will also be working hand in hand with both our regional and global networks to initiate complementary workstreams for our clients in APAC.

“We will continue to invest and win in digital as part of our wider goal to be our clients’ most trusted business transformation partner,” said Charlotte Lee, CEO of OMD APAC.

“It is our global ambition to continue our leadership position in digital, data and technology. In line with this ambition, we are excited to have Singh come on board the OMD APAC leadership team. His background of agency, in-house and start-up experience position him perfectly to understand and address our clients’ business needs,” added Lee.

“Digital media and access to our audience, as we know it, is changing quite rapidly around us. This puts most of us in a delicate but remarkable position, a position from which we can shape and contribute to conversations about the next evolution of digital media. As we embark on this journey, I want to leverage the strength of the OMD network – people, technology, data, tools and platforms – to help our clients pivot and navigate through all the new and evolved possibilities in digital media. With this, I aim to position OMD as an unrivaled partner for our current and future clients; to dominate and succeed in this incredibly competitive and multifarious digital realm,” said Singh.

Singh will report to Lee, and work closely with the team including Chief Strategy Officer (CSO), David McCallen, and Chief Client Officer (CCO), Sadhan Mishra, to drive and support APAC local markets as well as regional clients on digital, data and technology needs.

Mishra was promoted to CCO of OMD APAC recently in June 2023. He will continue to be CEO of OMD Singapore, a position he was promoted into last August. Mishra has been with OMD for over 13 years and in his concurrent new role as CCO, he will focus on key client relationships, understanding their business needs and ensuring we remain a critical partner on their transformation journeys.

McCallen was elevated to the role of CSO of OMD APAC in April 2022, and was previously the CSO of OMD New Zealand for five years where he helped the agency to attain the top place in the market for new business, overall billings and award wins. Since starting in the APAC role, his focus has been on connecting and elevating strategic best practices across the region, building capabilities across a range of strategic outputs, and supporting new business growth both regionally and locally.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

test6

test

test

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Chandrayaan 3: Brands over the Moon

Some of the best moment marketing posts on India's crucial lunar mission

The nation is in a celebratory mood with its moon mission Chandrayaan 3 making its smooth landing on the lunar surface on the evening of August 23, 2023. The Pragyan rover is in pursuit of discovering water on the moon and is a vital feat for India's ambitious space research.

To celebrate this momentous episode in Indian space research history, netizens have taken to the internet to express their excitement, hopes and fears for the nation's lunar mission. Joining them are brands who have crafted creatives to mark the historic occasion and capture the emotions of the nation who have their eyes set on the moon. Here is our pick of some of the best Chandrayaan 3-moment marketing posts.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

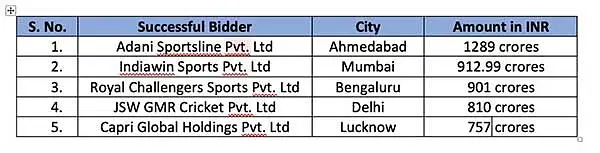

BCCI rakes in Rs 4670 cr in Women's Premier League team auction: Jay Shah 26 Jan

WPL has broken the inaugural auction record of Men's IPL in 2008, tweeted Shah

As expected, Wednesday turned out to be another historic day in Indian women's cricket with BCCI having a windfall gain of Rs 4,600 crores by auctioning five team franchises for the first season, a higher sum compared to what men’s IPL franchises offered to the cricket body during the launch in 2008.

Adani, IndiaWin Sports, Royal Challengers, GSW- GMR cricket and Capri Global have won the bid, BCCI secretary Jay Shah tweeted.

Shah shared in a series of tweets, “Today is a historic day in cricket as the bidding for teams of inaugural #WPL broke the records of the inaugural Men's IPL in 2008! Congratulations to the winners as we garnered Rs.4669.99 Cr in total bid.”

“This marks the beginning of a revolution in women's cricket and paves the way for a transformative journey ahead not only for our women cricketers but for the entire sports fraternity. The #WPL would bring necessary reforms in women's cricket and would ensure an all-encompassing ecosystem that benefits each and every stakeholder.”

“The @BCCI has named the league - Women's Premier League (WPL). Let the journey begin…”

The country's top corporates had bid aggressively for the league. Over 16 groups including IPL franchise owners, Adani group, Torrent and Haldiram were believed to be in the fray.

Given the popularity of IPL in India, the event is touted to be a big draw for all stakeholders involved.

The BCCI was reportedly expecting ₹4,000 crore gain through team auction.

It’s noteworthy that Viacom18 has won the Women's IPL media rights for Rs 951 crore for the next five years creating euphoria around the league whose first season will be held in March.

Read more news about (internet advertising India, internet advertising, advertising India, digital advertising India, media advertising India)

For more updates, be socially connected with us onInstagram, LinkedIn, Twitter, Facebook Youtube & Whatsapp

Share

Share